Failure to create a payroll ACH file is a violation of which customer service principle?

Which of the following statements is TRUE regarding the pre-notification process?

On June 1st, the Payroll Department received an SUI rate change notice indicating a new rate effective January 1st of the current year. The system was not updated with the new rate until October 1st. SUI contribution recalculation will need to be done for:

The lowest priority is given to which of the following time management categories?

The journal is commonly referred to as the record of:

The FLSA is enforced by which of the following entities?

All of the following preventative measures would help protect personally identifiable information EXCEPT:

Which of the following situations does NOT reflect constructive receipt of wages?

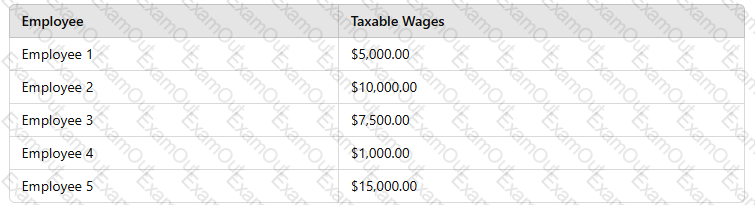

Using the table of taxable wages below, calculate the employer'sFICA tax liabilityon the first check of the year:

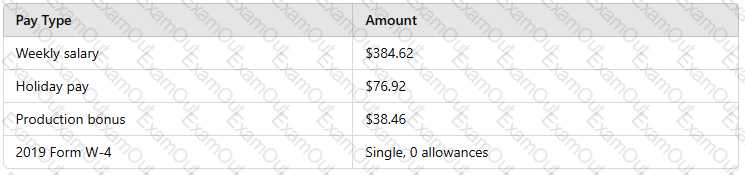

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information: