An out-of-balance condition in the general ledger could be caused by:

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

Employers can take advantage of all of the following affordability safe harbors set forth in the ACA regulations EXCEPT:

All of the following standards demonstrate effective communication techniques EXCEPT:

Which of the following awards are included in an employee's taxable income?

The FINAL phase of the accounting process involves the:

A state's minimum wage is $0.60 higher than the federal minimum wage. Under the FLSA, for an employee age 20, what is the MINIMUM hourly rate an employer can pay the employee?

To stop payment on an employee's check, the employer must work with the:

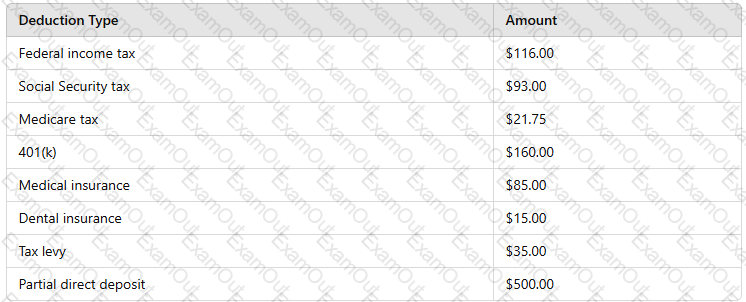

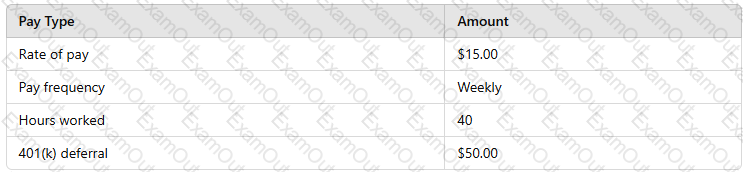

Using the wage bracket method, calculate the employee’s net pay. The employee’s W-4 was completed in 2019 or earlier.

An employee receives $1,600.00 biweekly from their employer. Using the following information, calculate the total amount of voluntary deductions.