Under the rules of constructive receipt, the employee is considered paid:

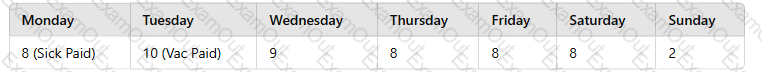

Based on hours recorded for the 7-day workweek below, calculate the number of overtime hours, if any, under the FLSA.

All of the following activities are examples of an internal control EXCEPT:

When an employee fails to cash a payroll check and the employer cannot locate the employee, the Payroll Department should:

All of the following plans are deferred compensation plans EXCEPT:

Which of the following account types has a normal debit balance?

All of the following employee information is required when reporting unclaimed wages EXCEPT:

The types of accounts used by businesses to classify transactions are:

Employers who properly repay over-withheld amounts to employees can claim a credit against taxes due by making an adjustment on:

As of December 31, 2024, what is the MAXIMUM amount, if any, a 49-year-old employee can contribute to a 401(k) plan?