Which of the following statements is a true statement about flexible budgets?

Ladron Candies is analyzing sales and production data for the holiday boxes they produced last year. The company expected to use 0.10 direct labor hours to produce one box of specialty candy, and the variable overhead rate was $2.00 per hour. According to payroll records, the company paid for a total of 104,000 hours of direct labor wages. The actual variable overhead costs totaled $200,000. They sold 800,000 boxes of candy to retailers. What is the variable overhead efficiency variance?

You are the financial accountant for Antioch Ski Resort. Managers have been promised end-of-year bonuses if profits for the year increase by 10%. At the end of the year, you determine that profits increased by only 8%, and the managers ask you to "fudge the numbers a bit" so they can still receive their bonuses. What should you do?

Which of the following would be a measure of managerial accounting?

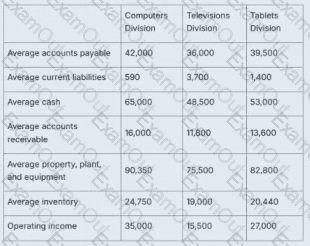

This is select financial statement data for the three divisions of Technology Goods, Inc. Assuming all assets are operating assets, what is the return on investment for each division?

Given Data from Image (relevant for ROI):

Let’s calculate ROI for each division using:

ROI = Operating Income / (Average Cash + Accounts Receivable + Property, Plant, Equipment + Inventory)

Step 1: Compute average operating assets for each division:

Computers Division:

= 65,000 (Cash) + 16,000 (AR) + 90,350 (PP&E) + 24,750 (Inventory)

= 196,100

ROI = 35,000 / 196,100 ≈ 17.85%

Televisions Division:

= 48,500 + 11,800 + 75,500 + 19,000 = 154,800

ROI = 15,500 / 154,800 ≈ 10.01%

Tablets Division:

= 53,000 + 13,600 + 82,800 + 20,440 = 169,840

ROI = 27,000 / 169,840 ≈ 15.89%

Wycliff Corporation practices activity-based management at their manufacturing facility. Which of the following events would most likely be the result of a decision made using activity-based management theory?

Ladron Candies uses activity-based costing to allocate variable factory overhead costs. Which of the following statements best represents the excerpted activity data for indirect materials?

Indirect Materials:

Strang Tax provides tax consulting services to its clients whom they charge on an hourly basis. They would like to use differential analysis to determine whether profits would change if they dropped certain clients. Which of the following items should be excluded from this analysis?

Coffee Beanz, Inc. currently maintains decentralized operations. The CEO is evaluating whether the company should centralize their operations. Which of the following situations would make centralized operations more beneficial than decentralized?

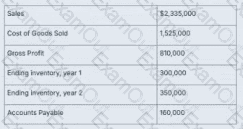

This is select financial statement data for Binks Corporation. What is the inventory turnover ratio for year 2?