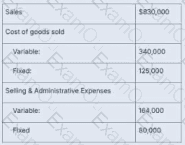

Using this data, what is the contribution margin?

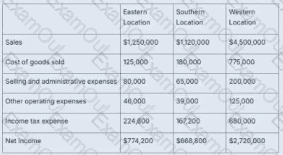

Waffles, Inc. is evaluating their annual bonus allocations for restaurant division managers. This is the segmented income statement data for the three individual restaurant locations of Waffles, Inc. What does this information tell us about the performance of each division manager?

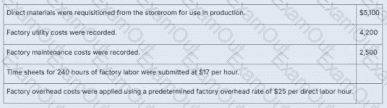

What is the balance in the manufacturing overhead account after these transactions were recorded, assuming the beginning balance was zero?

Now calculate the balance:

Manufacturing Overhead Balance = Actual Overhead – Applied Overhead

= $6,700 – $6,000 = $700 underapplied

Underapplied overhead → debit balance in Manufacturing Overhead account

Bethel Bakery manufactures frosted sugar cookies. They maintain separate work-in-process accounts for their blending, cutting, baking, decorating, and packaging departments. Which costing method is Bethel Bakery most likely using?

SJ Candles subscribes to a management theory known as management by exception. Which of the following best describes a situation where management by exception would be applied?