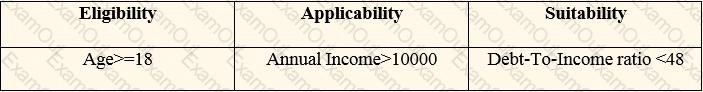

U+ Bank, a retail bank, is currently presenting a cashback offer on its website. Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer.

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45 As business user, what are the two tasks that you define to update the cashback offer? (Chose Two)

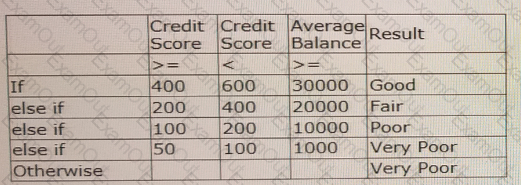

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

U+ Bank, a retail bank, uses the Business Operations Environment to perform its Business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 operations Manager Portal.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of an engagement policy condition. In which portal do you create the change request to fulfill new business requirement?

U+ Bank uses Pega Customer Decision Hub™ to display an offer to its customers on the U+ Bank website.

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

MyCo, a telecom company, introduced fiber optic service in the northern region of the country. They want to advertise this service on their website by using a banner and target the customers living in that area.

What do you need to configure in the Next-Best-Action Designer to implement this requirement?