U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full customer life cycle: marketing, sales, and service.

Which two valid actions do you create? (Choose Two)

To reference a customer property in a strategy, you need to prefix the property name with the keyword______________.

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer to the qualified customers on its website. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning consultant, you are now expected to make the remaining configurations in the Next-Best-Action Designer's Channel tab to enable the website to communicate with the Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you perform in the Next-Best-Action Designer's Channel tab? (Choose Two)

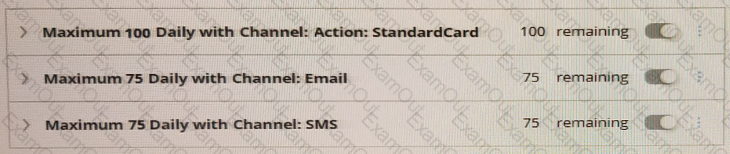

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel.

If the following volume constraint is applied, how many actions are delivered by the outbound run?

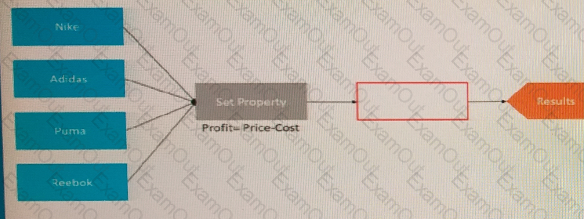

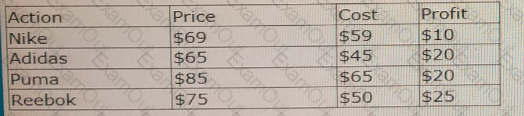

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

What is the number of outputs that each component has?

You are the decisioning consultant on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

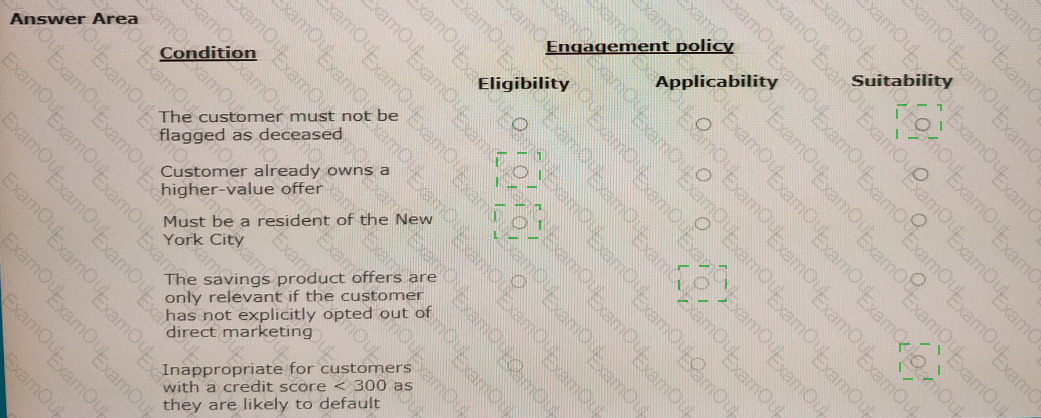

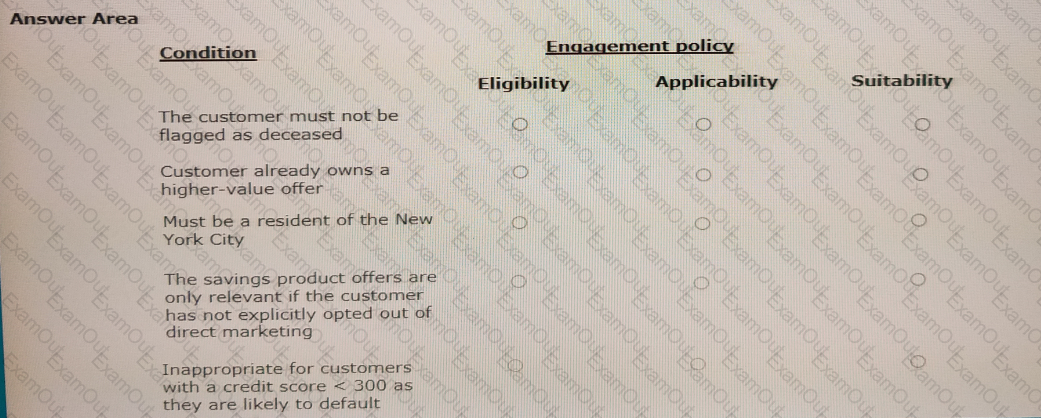

In the Answer Area, select the correct engagement policy for each condition.

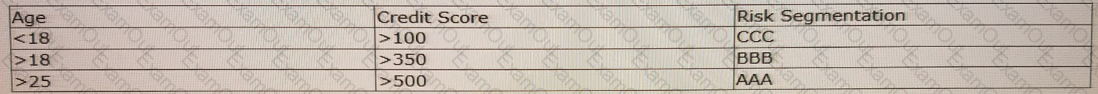

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?