The spot exchange rate between USD and AUD is 0.70. The risk free interest rates in the US and Australia are 2% and 3.5% respectively. What is the forward exchange rate between the two currencies one year hence?

The price of an interest rate cap is determined by:

I. The period to which the cap relates

II. Volatility of the underlying interest rate

III. The exercise or the strike rate

IV. The risk free rate

Which of the following reflects the pricing convention for currency forwards, where one of the currencies is USD?

Which of the following statements are true:

I. The convexity of a zero coupon bond maturing in 10 years is more than that of a 4% coupon bond with a modified duration of 10 years

II. The convexity of a bond increases in a linear fashion as its duration is increased

III. Convexity is always positive for long bond positions

IV. The convexity of a zero coupon bond maturing in 10 years is less than that of a 4% coupon bond maturing in 10 years

[According to the PRMIA study guide for Exam 1, Simple Exotics and Convertible Bonds have been excluded from the syllabus. You may choose to ignore this question. It appears here solely because the Handbook continues to have these chapters.]

The profit potential from the conversion of convertible bonds into stock is limited by

The 'transformation line' expresses the relationship between

Which of the following statements is true:

I. A high market beta implies a high degree of correlation with the market

II. Correlation coefficient and covariance between assets have the same sign

III. A correlation of zero indicates the absence of a linear relationship between the two assets

IV. Unless assets are perfectly correlated, diversification always reduces portfolio risk.

A stock is selling at $90. An investor writes a covered call on the stock with an exercise price of $100 in return for a premium of $3 per share. What would be the maximum gain or loss per share that the investor could make on this position?

Which of the following statements is true for a Credit Linked Note (CLN)?

Which of the following statements are true:

I. An yield curve plots zero coupon spot rates for different maturities for bonds with different credit ratings

II. An yield curve represents the term structure of interest rates for similar instruments across a range of maturities

III. The liquidity preference theory explains why the yield curve can be downward sloping

IV. The term structure refers to the relationship between bond yields and bond maturities

103.04.e2

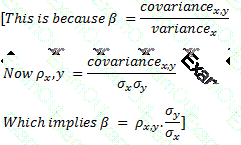

103.04.e2 103.04.e2, where x is the market portfolio and y is the asset under consideration.

103.04.e2, where x is the market portfolio and y is the asset under consideration. 103.04.e

103.04.e