The LIBOR square swap offers the square of the interest rate change between contract inception and settlement date. If LIBOR at inception is y, and upon settlement is x, the contract pays (x - y)2 for x > y; and -(x - y)2 for x < y.

What of the following cannot be a value of the gamma of this contract?

Calculate the number of S&P futures contracts to sell to hedge the market exposure of an equity portfolio value at $1m and with a β of 1.5. The S&P is currently at 1000 and the contract multiplier is 250.

Which of the following are true:

I. A interest rate cap is effectively a call option on an underlying interest rate

II. The premium on a cap is determined by the volatility of the underlying rate

III. A collar is more expensive than a cap or a floor

IV. A floor is effectively a put option on an underlying interest rate

An asset manager holds an equity portfolio valued at $25m with a beta of 0.8. She would like to reduce the beta of the portfolio to 0.6 for the next 3 months using index futures. Index futures are curently trading at 1450, and the contract multiple is 250. How should the asset manager trade the index futures to get his desired result? Assume her portfolio is well diversified.

An investor enters into a 4 year interest rate swap with a bank, agreeing to pay a fixed rate of 4% on a notional of $100m in return for receiving LIBOR. What is the value of the swap to the investor two years hence, immediately after the net interest payments are exchanged? Assume the current zero coupon bond yields for 1, 2 and 3 years are 5%, 6% and 7% respectively. Also assume that the yield curve stays the same after two years (ie, at the end of year two, the rates for the following three years are 5%, 6%, and 7% respectively).

If the CHF/USD spot and 3 month (91 days) forward rates are 1.1763 and 1.1652, what is the annualized forward premium or discount?

Which of the following statements are true:

I. For a delta neutral portfolio, gamma and theta carry opposite signs

II. The sum of the absolute value of gamma for a call and a put for the same option is 1

III. A large positive gamma is desirable in a delta neutral portfolio

IV. A trader needs at least two separate tradeable options to simultaneously make a portfolio both gamma and vega neutral

Which of the following best describes a 'when-issued' market?

For a pair of correlated assets, the achievable portfolio standard deviation will be the lowest when the correlation ρ is:

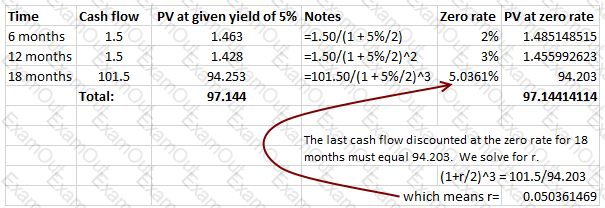

The yield offered by a bond with 18 months remaining to maturity is 5%. The coupon is 3%, paid semi-annually, and there are two more coupon payments to go in addition to the interest payment made at maturity. The zero rate for 6 months is 2%, that for 12 months is 3%. What is the 18 month zero rate?