What is binding authority?

[Insurance Documents and Processes]

Usually, what must an insurance intermediary do before using the personal information of a client for a purpose other than that for which the information was originally collected?

[Insurance Documents and Processes]

Rashida claims she told her broker about the swimming pool when binding coverage. The adjuster disputes coverage because the insurer was not informed. What should have been done to prevent this dispute?

[Insurance Categories and Functions]

Which risk could be insured bychattel coverage?

[Insurance Companies]

What type of company has the authority to bind coverage for a specific line of business as outlined by an insurer?

[Insurance Companies]

Ace Brokerage Inc., a liability insurer, has been in business for three years. It is suffering financial difficulties despite writing a significant amount of new business. What is the most likely reason?

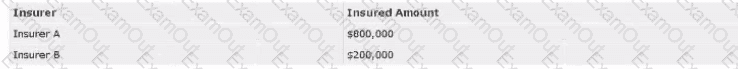

Insurer A and Insurer B cover the same building and the policies are NOT subject to contribution. The building sustains a loss of $450,000. How can the insured claim for their loss?

[Introduction to Risk and Insurance – Benefits of Insurance]

How would a moving and storage company benefit from purchasing insurance to cover customers’ goods while in transit?

[Insurance Companies]

Which type of insurance company has the same capital structure as any other capital enterprise?

[Insurance Companies / Reinsurance]

An insurer writes a $60,000,000 risk for a premium of $30,000. Using pro rata reinsurance, it transfers 25% of the risk to the reinsurer. The risk then suffers a $100,000 loss. How much does the reinsurer contribute to this loss?