[Insurance as a Contract]

Which statement best explains the concept of utmost good faith?

[Regulatory Framework]

Which legal term describes the time in which a claim may be brought by the policyholder?

[Regulatory Framework]

Why does the Office of the Superintendent of Financial Institutions (OSFI) control the types of investments insurers are allowed to make?

[Insurance Documents and Processes]

What type of wording is written on a custom basis for a specific situation?

When one reinsurer cedes part of its business to another reinsurer, what is the second reinsurer called?

[Introduction to Risk and Insurance]

What is a disadvantage of loss retention through borrowing?

A large commercial brokerage is approached by a new client who owns a spacecraft and wants liability insurance. What solution should the brokerage recommend?

[Insurance Companies – Reinsurance (Non-Proportional / Excess of Loss)]

Cover It Insurance has a non-proportional reinsurance agreement with ZYX-Reinsurance:

$600,000 excess of $300,000.

Which payout is accurate?

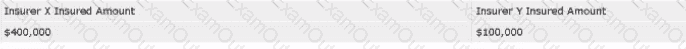

A company suffers a $100,000 property loss at its commercial location. If Insurer X and Insurer Y have policies subject to the same terms and conditions, and there is no deductible, what will each insurer pay based on the information below?

Insurer X insured amount: $400,000

Insurer Y insured amount: $100,000

[Industry Organizations; The Customer]

What does the Institute for Catastrophic Loss Reduction (ICLR) encourage?