M is a multinational IT company with headquarters in Asia and with operations in all continents.

It is now trying to expand its operations in Europe. This is seen as a major challenge as the European market is very well developed with established players in fierce competition against each other.

As well as developing and producing its own products, it sources products across Asia, America and Europe as part of infrastructure deals which have to include as much of its own equipment as possible. In doing this, transfer prices can be set in YEN, USD, EURO, GBP. Transfer prices are revised every month in line with production times as most goods are made on short order times with sales cycles running at 3-4 months.

The longer sales cycle against committed transfer pricing presents problems as customers expect quotes to be valid for 90 days whereas M's suppliers reserve the right to revise pricing at the end of every month with quotes only valid for 8 days in the following month.

How should M deal with this problem?

SQH manufactures mobile phones SQH's Board is currently undertaking a long-term planning exercise as part of the process of strategy development The Board is considering expanding the number of countries it currently exports products to.

Which THREE of the following could cause difficulty in forecasting accurately'?

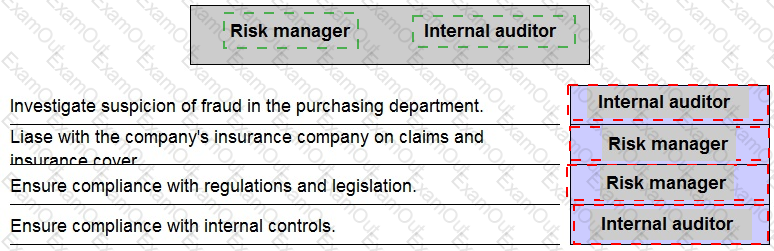

The list below has duties performed by risk managers and internal auditors. Show who would carry out the duties assuming the company has both risk managers and internal auditors.

CVB is a major chain of pharmaceutical retailers that is quoted on its home stock exchange.

CVB's Chief Executive Officer (CEO) persuaded a former school friend to join CVB's Board as Non-executive Chair It is not widely known that the two have been lifelong friends. The Chair tends to defer to the CEO on all matters arising at Board meetings

Which of the following statements are correct?

Select ALL that apply.

Which of the following are true of an effective risk management culture?

Which of the following statements are true of residual risk?

COM is a well established company in the construction industry The company was founded by the Mac family 30 years ago and several family members still serve on the Board The company obtained a listing five years ago The Board has an appropriate balance between executive and non-executive members It also has audit remuneration and nomination committees The average age of board members is 68

COM is profitable but profit margins have been falling steadily and this year's revenues are lower than it was achieved last year The Board recognis thai it does not have a long term strategy in place and has been losing business to newer, more aggressive competitors

Which THREE of the following statements are correct?

In relation to the use of the adjusted present value (APV) technique, which of the following statements are correct?

R is a manufacturer of biscuits. The market for biscuits is extremely competitive with many companies competing for contracts with large supermarkets. The intensity of the competition means that prices are kept low; and the buyers can demand higher levels of quality, and greater flexibility in supply arrangements.

Which of the following represent ways that the use of an Information System could help R to win and retain supermarket contracts in such a competitive market?

B is a family run security company with a number of prestigious clients who rely on it to maintain online access to their CCTV and alarm systems and respond to any detected intrusions or malfunctions.

It designs and installs security systems for a number of UHNW (Ultra High Net Worth) individuals who may have several seasonal and city residences largely unoccupied for many months of the year.

B's reputation as 100% secure is crucial to its on-going success in this very specialised marketplace.

Select THREE factors which should be given prominence in B's fraud risk management strategy.