QAW is a quoted building company QAW has detailed rules relating to the wording of its contracts and the need to seek Board approval for any changes to the standard wording

The Convener of the Audit Committee has just received a copy of an internal audit report relating to the QAW Land Reclamation subsidiary The subsidiary has signed several construction contracts over the past two years that have made significant changes to the standard wording, with no attempt to seek approval from QAW's Board

The internal audit report quotes the manager in charge of QAW Land Reclamation as refusing to accept that there is a compliance error at the subsidiary The manager stated that the nature of the business done by QAW Land Reclamation would make it inappropriate to use the standard contract terms and that it would be impractical to seek permission for every one of the many changes that are necessary

Which of the following would be an appropriate response to this item by QAW's Board?

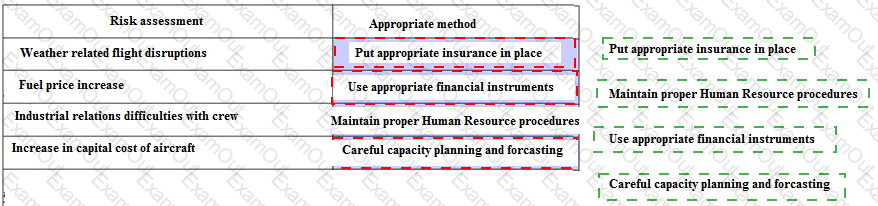

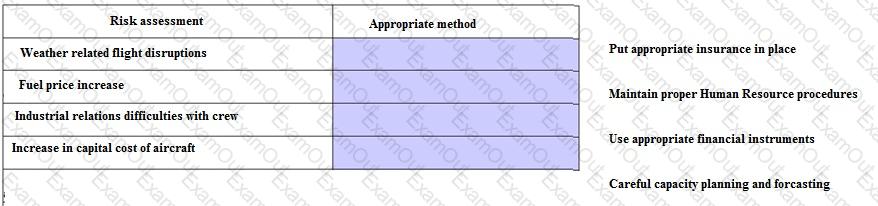

As part of risk assessment exercise for a low-cost airline you are requested to match the risks listed below with the most approriate method of minimising or dealing with each risk.

C Ltd is a private, family-owned company which is hoping to become listed on a recognised Stock Exchange within the next two years. At the moment, the Board of Directors comprises five directors; four of whom are from the founding family and all of whom are involved in the day-to-day running of the business. The remaining director obtained a seat on the Board three years ago as a condition of an investment by a venture capital fund.

The Board meets in half-day sessions once a fortnight and the Board meetings are reasonably well run. All decisions are taken by the Board as a whole. There are no sub-committees.

Which of the following steps would it be appropriate for C Ltd to take in the light of the proposed listing?

You have just been employed as a management accountant in a small business with an annual turnover of $0.5 million.

You have a wide range of duties because the business is small.

Which of the following is an ethical risk?

B is a quoted construction company. Its Board consists of qualified and experienced engineers Which TWO of the following statements are correct?

An oil company has entered into a joint venture with a competing oil company to develop a new oil field. The joint venture arrangement is intended to mitigate the risks associated with developing the oil field.

The following disclosure appears in the oil company's risk report:

"Many of our large projects and operations are conducted through joint ventures. These arrangements involve complex risk allocation and indemnification arrangements and we have less control over these activities than we would have if we had full ownership and control. Our partners may have economic or business interests that are opposed to ours, and may exercise the right to block key decisions or actions. We believe the joint arrangement is in our best interest."

Which of the following statements are correct?

S Doc is an out-of-hours service provided by a country's government. The service allows members of the public to call and speak to a nurse who can advise on medical situations which are not obviously emergencies. Depending on the situation the caller can be referred to the full emergency services, or be advised to go to Accident and Emergency at the nearest hospital. Alternatively, a callout from a general practitioner (GP) can be organised; the caller can be advised of where GP services are available; advice can be given over the phone; or a decision can be taken that no further action is required at least until normal services resume on the next working day.

There has been a suggestion that the nurses who take these calls could be replaced by suitably trained operatives who have available to them a specially designed expert system.

Which of the following are advantages of using an expert system instead of nurses?

P Ltd, a manufacturing company, is considering a new capital investment project to set up a new production line. The initial appraisal shows a healthy net present value of $6,465 million at a discount rate of 10% as shown in the table below:

However, management is unsure about the demand for the product which will be produced and has insisted that the future revenues should be reduced to certainity equivalents by taking 70%, 65% and 60% of the years 1,2, and 3 cash inflows respectively.

What should P do?

T is an accountant who has been accused of professional incompetence T agreed to advise a client on currency management and the client lost a great deal of money when a large foreign currency trade receivable declined in value without having been hedged.

Which of the following factors strengthens the case that T has been incompetent?

Select ALL that apply

The managers of a company are agents for the shareholders tasked with increasing shareholders' wealth. Which of the following will usually increase shareholders' wealth?