Under the COSO Enterprise Risk Management Framework, who is responsible for risk management?

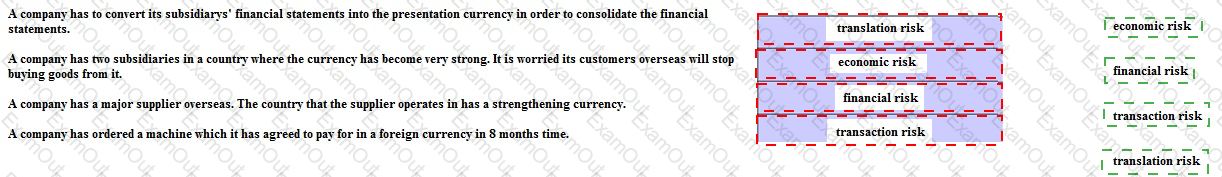

Move the category of risk to the box beside the risk description it best matches.

Which THREE of the following are true with regard to managing the changeover from an old to a new computer system?

JKL is a retailer with more than 45 shops around the country. The directors suspect that a serious fraud has occurred at one of the branches and a team of internal auditors has been sent to investigate

An analytical review investigation shows that sales revenue is in line with budget, but overtime payments to shop staff exceed budget by 20%.

How should the internal audit team proceed?

SDF has a variable rate loan of $100 million on which it is paying interest of LIBOR + 2%.

SDF entered into a swap with CV bank to convert this to a fixed rate 7% loan. CV bank charges an annual commission of 0.3% for making this arrangement.

Calculate the net payment from SDF to CV bank at the end of the first year if LIBOR was 3% throughout the year.

Give your answer in $ million, to one decimal place.

The management of U is reviewing internal controls throughout the company. It has noted the following:-

1. In the trade receivables section, journal adjustments are made by the clerks, without any reference to their supervisor. Journal adjustments may relate to sales returns, discounts allowed, or transfers between accounts.

2. In the purchasing department, the purchasing manager selects and approves all suppliers, as they are the only person with sufficient experience to do so. They use a very limited number of suppliers because they can rely on these suppliers to provide goods of the quality required at a competitive price. They do not keep any documents in relation to negotiations with other potential suppliers or other quotes obtained.

In relation to the above, which of the following statements are valid?

A project has an NPV of £1,200,000. The present value of material costs which are included in the NPV calculation are £8,000,000.

What is the sensitivity of the project to changes in material costs?

Give your answer to the nearest whole percentage.

Company N is considering opening another production plant in Northland, a country 2000 km from its current production plant location N would also sell its products in Northland

Which TWO of the following are business risks'

M, a manufacturing company, has had some problems with defects in one of the main products it produces. This product has been made by the company for many years and is very profitable. Last month it had over 300 defects reported by customers which is more than 15% of products sold. This is a reputation risk for M and is also affecting profitability.

Which of the following controls could M introduce to reduce defects and also increase profitability?

Which of the following are true of interest rate swaps?