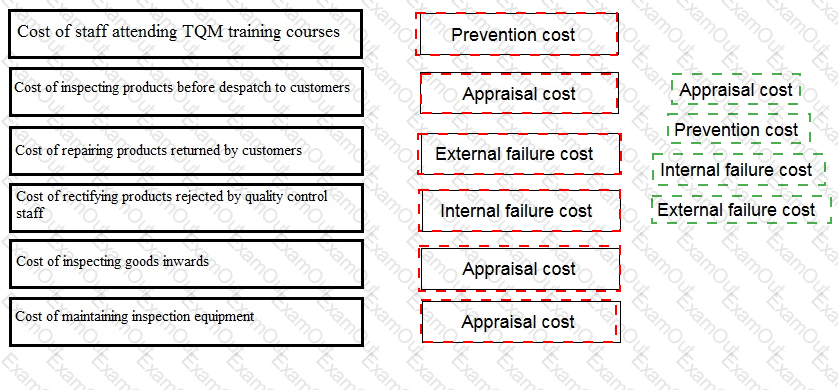

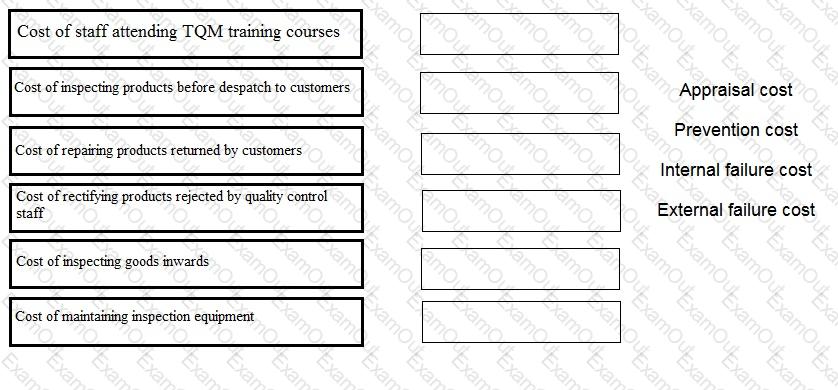

Place the correct quality cost classification against each cost described below.

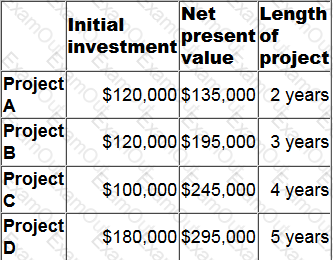

The following data are available for four projects with unequal lives.

A 10% discount rate is appropriate for all four projects.

Which project has the highest equivalent annual benefit?

A firm of accountants uses an activity-based costing system. The firm's costing system permits staff to indicate specific tasks undertaken for clients, such as requesting missing information. The amount charged for a request for missing information is based on the following analysis.

Each request takes an average of 15 minutes of professional staff time. Professional staff are charged out at $100 per hour.

Administrators then process the information request and prepare a standard letter. The average time administration staff spend on each information request is 20 minutes. The cost of administration staff at the firm is $75,600 per year. Administration staff work for a total of 6,000 hours per year. The cost of printing and posting a letter is $1.

Calculate the cost of an information request.

Give your answer to 2 decimal places.

The net present value of the cost of operating a machine for the next 4 years is £6,340. The discount rate used is 10%.

What is the equivalent annual cost and the present value of the cost in perpetuity of operating this machine?

Use discount factors to 3 decimal places.

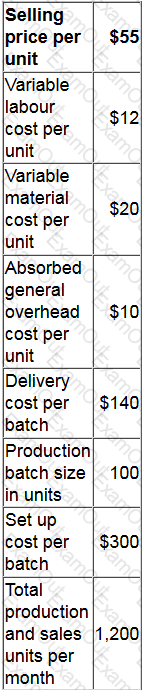

A large manufacturing company sells a range of products. Details of one of these products are as follows.

Each completed batch is delivered immediately in full to the one customer that purchases this product. The delivery vehicle is currently only 50% full when it makes these deliveries. The customer will accept deliveries of any size.

Managers are considering changing the production batch size to 150 units.

Increased material storage would be needed; this can be rented nearby at a cost of $1,500 per month.

The additional storage facility would enable an increase in the reorder quantity for the materials. As a result a 5% discount would be received on all materials purchased.

Using direct product profitability (DPP), what will be the monthly profit attributable to the product if the production batch size is changed to 150 units?

Give your answer to the nearest whole $.

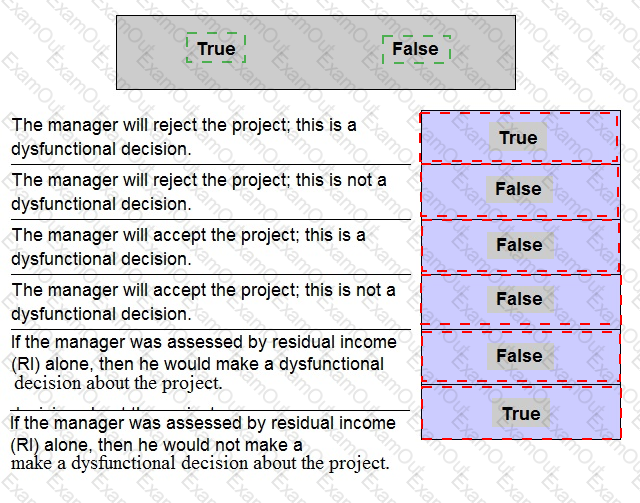

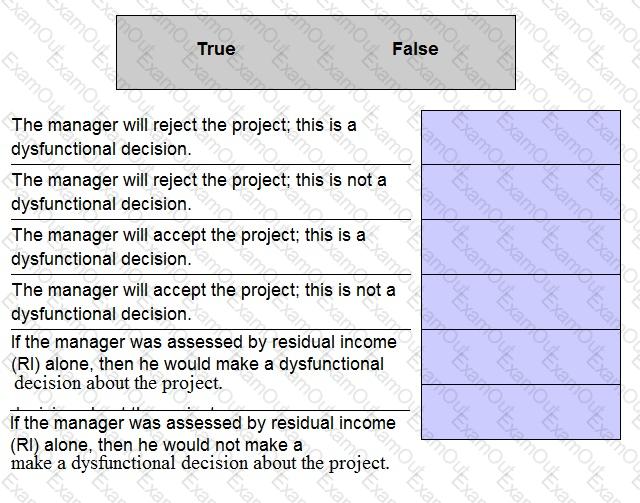

The performance of an investment centre manager is assessed by return on investment (ROI) alone. At present, his expected ROI for next year is 15%. The manager must now decide whether to invest in a new project that is expected to yield an ROI of 14%. The cost of capital is 12%.

Indicate whether each of the following statements is true or false.

You have just assessed an investment proposal, involving an immediate cash outflow followed by a series of cash inflows over the next 7years, by deducing the NPV and the IRR. You have now discovered that you have

underestimated the discount rate.

Correcting the underestimation will have the following effect, relative to your original deductions:

An electronics company sells a range of tablet computers. Tablet computers come complete with an operating system that is regarded as the market leader. The company aims to launch a new version of its hardware every eighteen months and a major update to its software every three years. The latest version of the tablet computer is always sold at a higher price, but the older version that has been replaced is then sold for a time at a discounted price.

Which pricing model does this company appear to be using?

When considering a capital investment, relevant costs for decision making have which THREE of the following features?

Which of the following is a correct description of the key features of net present value?