A company is investing $150,000 in a project which will yield an annual cash inflow of $40,000 for eight years. The company's cost of capital is 10%.

To the nearest $100, what is the project's equivalent annual net present value?

In an organization's transfer pricing system the selling division and the purchasing division each record a different price for the same transaction.

This is known as a:

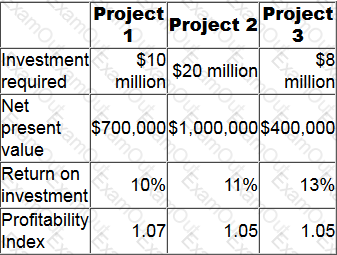

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

Which of the following statements is TRUE about the activity based costing system when compared to absorption costing method?

The discount rate at which the net present value (NPV) is zero is known as the

SDF is a newly-established production company that is experiencing high staff turnover in its factory. The production department is studying the manufacturing process and its associated learning curve.

Which of the following statements is correct?

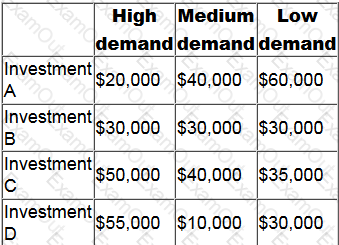

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Which investment would be selected using the maximin criterion?

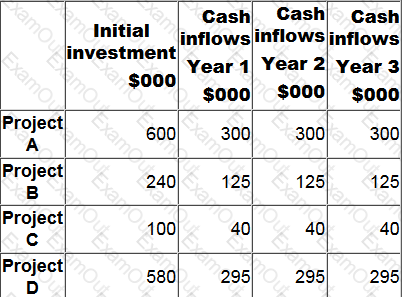

The following information is available for four investment projects:

A discount rate of 12% is appropriate for all four projects. The organization is subject to capital rationing and wishes to prioritise the projects using the profitability index (PI).

Which project has the highest PI?

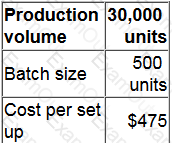

A manufacturing company sells a large range of products. Forecast data for the next period for one of these products are as follows.

After manufacture, each complete batch must be stored in a local warehouse until it is subsequently sent to the company's main national warehouse. The company does not own a local warehouse. A local warehouse with a maximum capacity of 500 units could be rented for $2,450 for the next period.

Alternatively a larger local warehouse with a maximum capacity of 700 units could be rented for $3,430 for the next period.The company will not begin the manufacture of any new batch until the previous batch has been sent to its main national warehouse.

What would be the change in the total cost of set up and storage if the batch size was changed to 600 units?

Give your answer to the nearest whole $.

Risk management can be represented as a four step process. The four steps, shown randomly, are:

1. Establish appropriate risk management policies.

2. Risks are identified by key stakeholders.

3. Risks are monitored on an ongoing basis.

4. Risks are evaluated according to the likelihood of occurrence and impact on the organization.

Which of the following is the correct order for the four steps?