Which of the following statements is true?

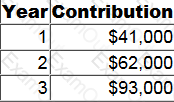

A company is considering investing $150,000 in a project which will generate the following contributions during the first three years.

Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises.

To the nearest $10, what is the forecast total project cash flow in year 3?

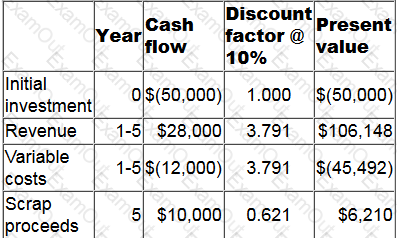

The following data relate to an investment opportunity.

The percentage reduction in the annual revenue that could occur before the project is no longer financially viable is:

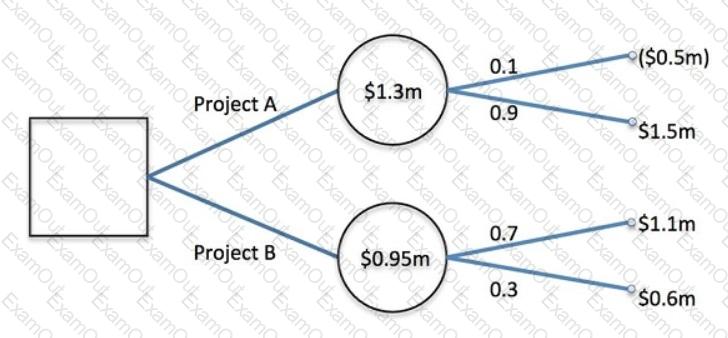

A company is deciding whether to invest in project A or project B. A decision tree has been prepared to illustrate the investment decision and its associated possible net present values (NPVs).

Which of the following statements is correct?

Beyond Budgeting is essentially an approach that places modern management practices within a cultural framework. Analyze the following statements:

1. The organization structure should have clear principles and boundaries.

2. Managers should be given a high degree of freedom to make decisions.

3. Frontline managers should be made responsible for relationships with customers.

4. Information system should be transparent and ethical.

Which of the above statements relate to Beyond Budgeting?

Kaizen costing is being used by an organization to gradually reduce the unit cost of one of its products in order to achieve a 20% mark up on the product's cost.

The selling price of the product must be $72 per unit and this selling price has been maintained for two years.

Two years ago the product's cost was $3 per unit more than its selling price. Kaizen costing has achieved an 8% reduction from the previous period's unit cost in each of the past two years. The organization expects to continue to achieve the same rate of cost reduction next year.

Which of the following statements provides an accurate analysis of the extent to which Kaizen costing has been successful in achieving the required unit cost for the product?

A project has a positive net present value (NPV) when discounted at a company's weighted average cost of capital (WACC). The project has also been evaluated using a range of other investment appraisal techniques.

It has now been recognized that the project is of much higher risk than the average risk of the company's existing portfolio of projects. It has therefore been decided that the discount rate to be used when evaluating this project should be the WACC adjusted for risk.

As the result of changing the discount rate as described, which of following statements are correct?

Select ALL that apply.

Which of the following would change if the cost of capital of a proposed project was increased?

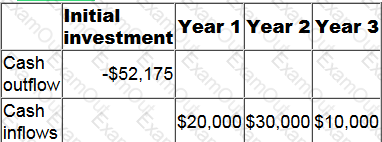

The cash flows from a project are detailed in the table below.

To the nearest 1%, what is the project's internal rate of return?

An organization has a decentralized structure in which division A supplies division B with an intermediate product for which there is no external market. Division B carries out further processing and then sells the final product on the external market. Due to organizational policy the current transfer pricing basis is variable cost.

The manager of division A has stated, "The current transfer price is unfair because it does not enable us to recoup our costs".

The manager of division B has stated, "The current transfer pricing system enables us to quote competitive prices for the finished product".

The Chief Executive of the organization is considering imposing a transfer pricing policy that uses dual pricing.

Dual pricing would: