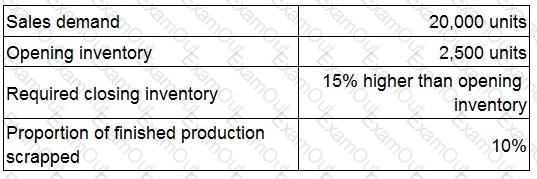

A manufacturing company is preparing the production budget for the forthcoming year.

The following budgeted information has already been obtained:

How many units will need to be produced for the forthcoming year?

Give your answer to the nearest whole number.

Which one of the following would NOT be included in a decision to close a division of an organization?

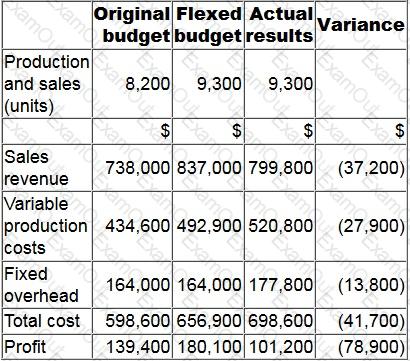

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

Which of the following are examples of feedforward control?

Select ALL that apply.

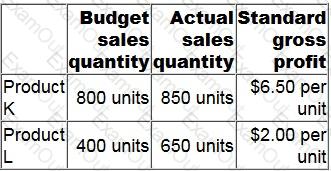

The following information is available regarding a company's two products for last period.

What is the favourable sales quantity profit variance for last period?

Give your answer to the nearest whole $.

A manager has not yet used all oh his budget. He is worried that his budget maybe reduced next year if he is not seen to have needed all the funds. He decides to spend the remaining £1,580 on another team building

exercise as well as a catered lunch for his department.

This example falls under which behavioural aspect of budgetary control?

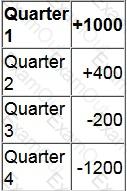

A company is forecasting sales volume using time series analysis. The following equation has been derived from past data and is considered to be a reliable predictor of future sales volume:

y = 20,000+80x

Where y is the total sales units each quarter and x is the time period (the first quarter of year 1 is time period 1).

The following set of seasonal variations for each quarter has been calculated using the additive model.

What is the forecast sales units for the second quarter of year 3?

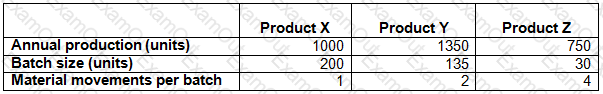

ABC uses an activity-based costing system.

The company manufactures three products, details of which are given below:

Total material movement costs for the period are $10,000.

The material movement cost per unit for Product Z (to the nearest $0.01) is:

Which THREE of the following are functional budgets?

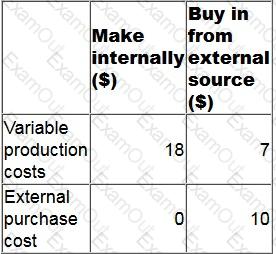

A company manufactures a range of products. It is deciding whether to make one of its products internally or to buy the product partially completed from an external source and complete the manufacture in-house. The table below gives details of the variable costs of the two alternatives. Fixed production costs will remain the same under both alternative.

What is the sensitivity of the decision to a change in the external purchase price?

Give your answer as a whole percentage.