A small manufacturing company makes a single product. Direct labour costs and factory rent account for 80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?

A company uses a standard costing system.

The company’s sales budget for the latest period includes 1,500 units of a product with a selling price of $400 per unit.

The product has a budgeted contribution to sales ratio of 30%.

Actual sales for the period were 1,630 units at a selling price of $390 per unit.

The actual contribution to sales ratio was 28%.

The sales volume contribution variance for the product for the latest period is:

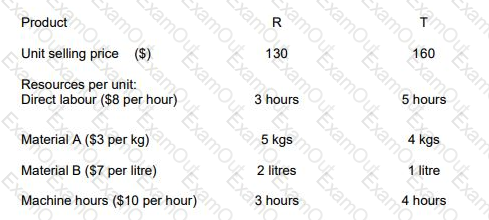

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified: Direct labour hours 7,500 hours

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

(Refer to previous 2 questions.)

You have now presented your optimum production plan to the purchasing and production managers of RT. During your presentation it became clear that the predicted resource restrictions were rather optimistic. In fact, the managers agreed that the availability of all of the resources could be as much as 10% lower than their original predictions.

Assuming that RT completes the order with the commercial customer, and using linear programming, show the optimum production plan for RT for June 2010 on the basis that the availability of all resources is 10% lower than originally predicted.

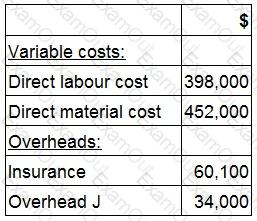

A company's product range includes Product N. The costs relating to Product N are shown below:

The direct labour costs relate to specialists employed to work wholly and exclusively with Product N.

If the company stopped making Product N, the insurance overhead cost would cease, but overhead cost J would be unaffected. Both overheads are absorbed in direct proportion to material costs.

Which of the following costs should be used in the decision whether to stop making Product N?

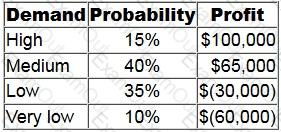

JDM is considering whether to go ahead with the launch of a new product. Profit from the new product is dependent on the level of demand.

The following table shows the estimated profits and their respective probabilities at different levels of demand.

The company could still cancel the launch of the product but would incur a cost of $7,000.

What is the maximum amount that the company should pay for perfect information about demand for the product?

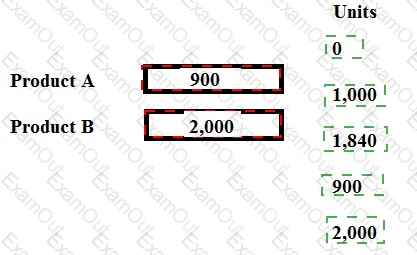

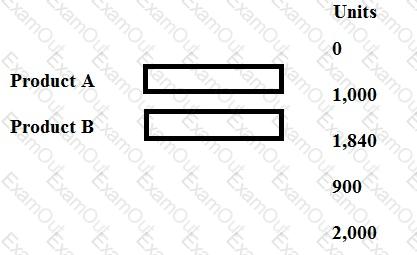

Demand for two products, A and B is 1,000 units and 2,000 units respectively. Each unit of Product A requires 8 kg of material and each unit of Product B requires 5 kg of material. The maximum availability of material is 17,200 kg. Contribution per unit of A is $10 and per unit of B is $9.

Place the production volumes of Product A and Product B, that will maximize contribution, in the table.

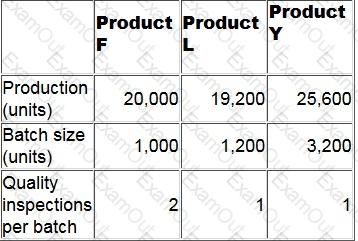

A manufacturing company uses activity-based costing to charge overheads to its three products. One of the main activities is quality inspection. The cost driver is the number of inspections and the budgeted cost is $211,200.

Additional budgeted data.

What is the budgeted quality inspection cost for a unit of product F?

Petco's material price standard was £8 per kg.

When looking over their accounts you calculate that in fact they they purchased 2,000kg at £6 per kg due to an overly abundant harvest that lowered global pet food prices.

You have been asked by your manager to analyse these figures and come to a conclusion.

With that in mind which of the following statements are correct? Select ALL that apply.

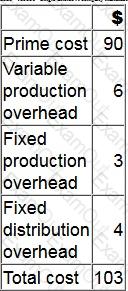

A company manufactures a single product. The cost card for a unit of this product is as follows:

During month 6, finished goods inventory increased by 350 units.

By how much would the profit differ in month 6 if finished goods inventory was valued at standard marginal cost rather than standard absorption cost?

A company has budgeted to produce 5,000 units of Product B per month. The opening and closing inventories of Product B for next month are budgeted to be 400 units and 900 units respectively. The budgeted selling price and variable production costs per unit for Product B are as follows:

Total budgeted fixed production overheads are $29,500 per month. The company absorbs fixed production overheads on the basis of the budgeted number of units produced. The budgeted profit for Product B for next month, using absorption costing, is $20,700.

Prepare a marginal costing statement which shows the budgeted profit for Product B for next month.

What was the difference between the profit calculation using marginal costing and the profit calculation using absorption costing?