The directors of a multinational group have decided to sell off a loss-making subsidiary and are considering the following methods of divestment:

1. Trade sale to an external buyer

2. A management buyout (MBO)

The MBO team and the external buyer have both offered the same price to the parent company for the subsidiary.

Which of the following is an advantage to the parent company of opting for a MBO compared to a trade sale as the preferred method of divestment?

Company A is subject to a takeover bid from Company B, both companies operate in the same industry and each of them demand a significant market share Company B h3S made an of an of $5 per share to the shareholders of Company A.

The directors of Company A do not believe the takeover would be in the best interests of the stakeholders and other stakeholders of Company A due to the following reruns

1. Company B has recently taken ever several ether companies resulting in them breaking up the company and se ling on the assets.

2 The directors of Company A believe the offer of $5 per snare undervalues tie company

The directors of Company A are therefore keen to prevent the bid from going ahead

Which THREE of the following defence strategies could be used by the directors of Company Air this situation?

RR has agreed to sell goods to XX for S20.000 XX will pay when the goods are delivered in 6 months time. RR's home currency is the £- The current exchange rate is 4.3 £/S. The projected inflation rate for the S is 2.8%, and for the E 4 6%.

When RR receives payment for its goods, what will the value be to the nearest pound?

A venture capitalist has made an equity investment in a private company and is evaluating possible methods by which it can exit the investment over the next 3 years. The private company shareholders comprise the four original founders and the venture capitalist.

Advise the venture capitalist which THREE of the following methods will enable it to exit its equity investment?

A company is considering either exporting its product directly to customers in a foreign country or establishing a manufacturing subsidiary in that country.

The corporate tax rate in the company's own country is 20% and 25% tax depreciation allowances are available.

Which THREE of the following would be considered advantages of establishing the subsidiary in the foreign country?

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness

Efficiency is defined as:

A Venture Capital Fund currently holds a significant shareholding in a large private company as a result of funding a recent management buyout. It plans to exit this investment in 5 years time at a significant profit.

Which THREE of the following exit mechanisms are most likely to be preferred by the Venture Capital Fund?

A company based in the USA has a substantial fixed rate borrowing at an interest rate of 3.5% and wishes to swap a part of this to a floating rate to take advantage of reducing interest rates Its bank has quoted swap rates of 3 4%-3 5% against 12-month USD risk-free rate.

What is the overall interest rate achieved by the company under this borrowing plus swap combination?

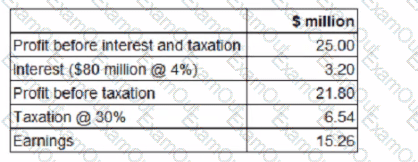

A company has a 4% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 4 times

• Retained earnings for the year must not fall below S5 00 million

The Company has 100 million shares in issue. The most recent dividend per share was $0 10 The Company intends increasing dividends by 8% next year.

Financial projections tor next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?