A product costs USD10 when purchased in the USA. The same product costs USD12 when it is purchased in the UK and the price in GBP is convened to USD.

Which of the following statement concerning purchasing power parity is correct?

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

Which THREE of the following are considered in detail in IFRS 7 Financial Instruments: Disclosures?

Which THREE of the following prevent the Purchasing Power Parity Model from operating effectively in practice?

A company has stable earnings of S2 million and its shares are currently trading on a price earnings multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is forecast to increase annual earnings straight away by 25% and then remain at that level for the foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

A company's Board of Directors wishes to determine a range of values for its equity.

The following information is available:

Estimated net asset values (total asset less total liabilities including borrowings):

• Net book value = $20 million

• Net realisable value = $25 million

• Free cash flows to equity = $3.5 million each year indefinitely, post-tax.

• Cost of equity = 10%

• Weighted Average Cost of Capital = 7%

Advise the Board on reasonable minimum and maximum values for the equity.

Company W is a manufacturing company with three divisions, all of which are making profits:

• Division A which manufactures cars

• Division B which manufactures trucks

• Division C which manufactures agricultural machinery

Company W is facing severe competitive pressure in all of its markets, and is currently operating with a high level of gearing Company W's latest forecasts suggest that it needs to raise cash to avoid breaching loan covenants on its existing debt finance in 6 months' time

In a recent strategy review. Divisions A and B were identified as being the core divisions of Company W

The management of Division C is known to be interested in the possibility of a management buy-out. Company Z is known to be interested in making a takeover bid for Company W's truck manufacturing division

A rival to Company W has recently successfully demerged its business, this was well received by the Financial markets

Which of the following exit strategies will be most suitable for company W?

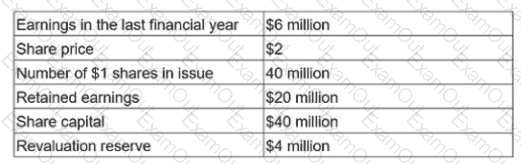

An unlisted company has the following data:

A listed company in the same industry has a P/E of 11.

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.

Company ABD and Company BCD operate in the same industry and each has a significant market share.

The directors of Company ABD have heard rumours in the market that Company BCD is planning to bid to takeover Company ABD. They do not believe the takeover would be in the best interests of the shareholders and are therefore keen to prevent the bid from going ahead.

Which THREE of the following defense strategies could be used by the directors of Company ABD at this point in time?

PYP is a listed courier company. It is looking to raise new finance to fit each of its delivery vans with new equipment to allow improved parcel tracking for customers The senior management team of PYP have decided on a 10-year secured bond to finance this investment-

Which TWO of the following variables are most likely to decrease the yield to maturity of the bond?