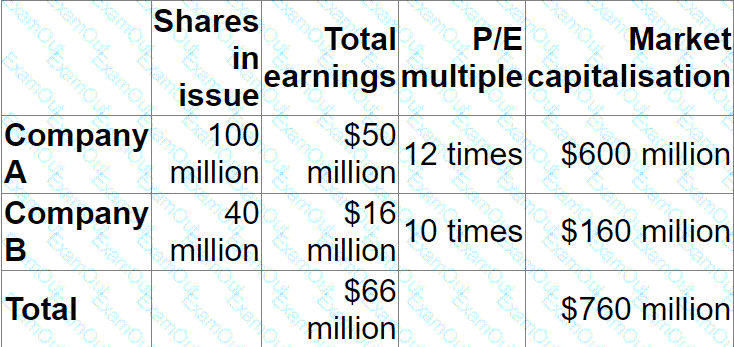

Company A plans to acquire Company B in a 1-for-1 share exchange.

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

Annual earnings are expected to increase by $4 million.

The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

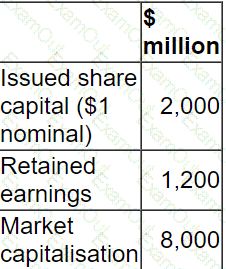

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

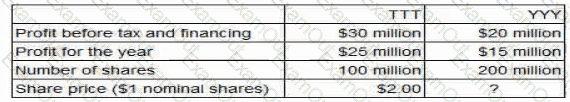

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

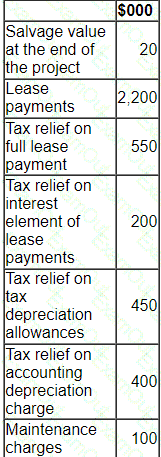

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

• Tax depreciation allowances can be claimed on purchased assets.

• If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

• Company A has 150 million shares in issue, with market price currently at $7.00 per share.

• Company T has 120 million shares in issue,. with market price currently at $6.00 each share.

• Synergies valued at $50 million are expected to arise from the acquisition.

• The terms of the offer will be 2 shares in A for 3 shares in T.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

WW is a quoted manufacturing company. The Finance Director has addressed the shareholders during WW's annual general meeting-She has told the shareholders that WW raised equity during the year and used the funds to repay a large loan that was maturing, thereby reducing WW's gearing ratio

At the conclusion of the Finance Director's speech one of the shareholders complained that it had been foolish for WW to have used equity to repay debt The shareholder argued that the Modigliani and Miller model (with tax) offers proof that debt is cheaper than equity when companies pay tax on their profits.

Which THREE arguments could the Finance Director have used in response to the shareholder?

Company A plans to diversify by a cash acquisition of Company B an unlisted company in another country (Country B) which operates in a different industrial sector

Company A already manufactures its product in Country B and has a loan denominated in Country B's currency

Company A regularly suffers foreign exchange losses due to volatility in the exchange rate between the two countries' currencies in recent years.

Which THREE of the following appear to be be valid justifications of this diversification decision?

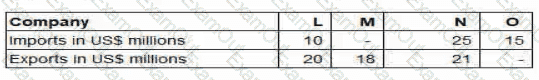

Companies L. M N and O:

• are based in a country that uses the RS as its currency

• have an objective to grow operating profit year on year

• have the same total levels of revenue and cost

• trade with companies or individuals in the United States. All import and export trade with companies or individuals in the United States is priced in US$.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the USS / RS exchange rate?

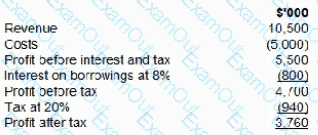

A company is considering taking out $10.000,000 of floating rate bank borrowings to finance a new project. The current rate available to the company on floating rate barrowings is 8%. The borrowings contain a covenant based on an interested cover of 5 times.

The project is expected to generate the following results:

At what interest rate on the floating rate borrowings is the bank covenant first breached?

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $10 0 million.

The rate of corporate tax is 20%.

The average P/E multiple of listed companies in the same industry is 10 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 11 times to 12 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 16 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?