A company is undertaking a lease-or-buy evaluation, using the post-tax cost of bank borrowing as the discount rate.

Details of the two alternatives are as follows:

Buy option:

• To be financed by a bank loan

• Tax depreciation allowances are available on a reducing-balance basis

• Assets depreciated on a straight-line basis

Lease option:

• Finance lease

• Maintenance to be paid by the lessee

• Tax relief available on interest payments and book depreciation

Which THREE of the following are relevant cashflows in the lease-or-buy appraisal?

A company gas a large cash balance but its directors have been unable to identify any positive NPV projects to invest in. Which THREE of the following are advantages of a share repurchase, compared with a one-off large dividend?

A company has:

• $6 million market value of equity

• $4 million market value of debt

• WACC of 11.04%

• Corporate income tax rate of 20%

According to Modigliani and Miller's theory of capital structure with tax, what is the ungeared cost of equity?

Company C is a listed company. It is currently considering the acquisition of Company D. The original founder of Company C currently owns 52% of the shares.

Alternative forms of consideration for Company D being considered are as follows:

• Cash payment, financed by new borrowing

• issue of new shares in Company C

Which of the following is an advantage of a cash offer over a share-for exchange from the viewpoint of the original founder of Company C?

ART manufactures traditional scooters. It has an equity beta of 1.4 and is financed entirely by equity. It plans to continue to be all-equity financed in future.

It is considering producing a range of electric scooters

GGG is a comparable quoted electric scooter manufacturer GGG has an equity beta of 2 4 reflecting its high level of gearing (the ratio of debt to equity is VI using market values).

The risk-free rate is 5%, and the market premium is 6%. The rate of corporation tax is 20%

What is the recommended discount rate that ART should use to assess the project to manufacture electric scooters?

A company has accumulated a significant amount of excess cash which is not required for investment for the foreseeable future.

It is currently on deposit, earning negligible returns.

The Board of Directors is considering returning this excess cash to shareholders using a share repurchase programme.

The majority of shareholders are individuals with small shareholdings.

Which THREE of the following are advantages of the company undertaking a share repurchase programme?

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

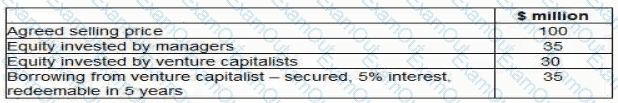

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

A company plans to raise finance for a new project.

It is considering either the issue of a redeemable cumulative preference share or a Eurobond.

Advise the directors which of the following statements would justify the issue of preference shares over a bond?

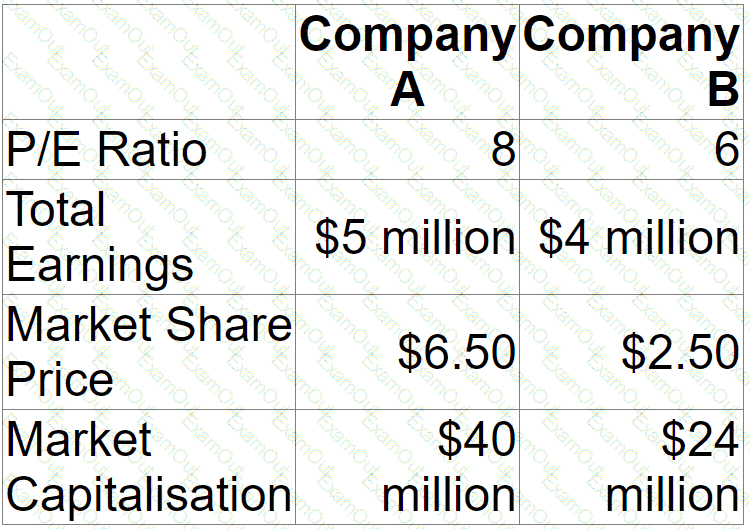

Company A is planning to acquire Company B.

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

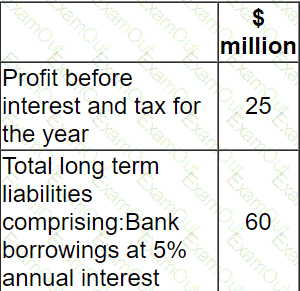

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?