Which THREE of the following statements are correct in respect of the issuance of debt securities.

Listed company R is in the process of making a cash offer for the equity of unlisted company S.

Company R has a market capitalisation of $200 million and a price/earnings ratio of 10.

Company S has a market capitalisation of $50 million and earnings of $7 million.

Company R intends to offer $60 million and expects to be able to realise synergistic benefits of $20 million by combining the two businesses. This estimate excludes the estimated $8 million cost of integrating the two businesses.

Which of the following figures need to be used when calculating the value of the combined entity in $ millions?

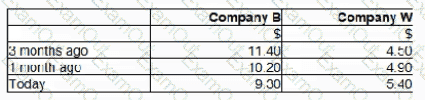

Company W has received an unwelcome takeover bid from Company B. The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition. These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

A publicly funded school is focused on providing Value for Money

It pays its leaching staff less than other schools, because class sizes are generally smaller than elsewhere Despite some staff demotivation from low pay, exam pass rates are high given the close one-to-one attention many pupils receive.

On which aspect of Value for Money is the school underperforming?

MAN is a manufacturing company that is based in country M and sells almost exclusively to customers in country M, priced in the local currency, M$.

MAN wishes to expand the business by acquiring a company that manufactures similar products but has a more global customer base. It is particularly interested in selling to customers in country P, which uses currency P$ but recognises that the P$ is generally quite volatile against the M$.

Country P uses the same language as country M, has free entry of labour from country M, no exchange controls or withholding tax and a favourable double tax treaty.

Which of the following companies would be most suitable takeover candidates for MAN to investigate further?

A company is considering the issue of a convertible bond compared to a straight bond issue (non-convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

• it will dilute their control

• the interest payments will be higher therefore reducing liquidity

• it will increase the gearing ratio therefore increasing financial risk

Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?

A company has a covenant on its 5% long term corporate bond.

• Covenant - The earnings must not fall below $7 million

The bond has a nominal value of $60 million.

It is currently trading at 80% of its nominal value.

The projected earnings before interest and taxation for next year are $11.5 million.

The company retains 80% of its earnings. It pays tax at 20%.

Advise the Board of Directors which of the following covenant conditions will apply next year?