A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed

The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns

The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange

Which THREE of the following statements about the advantages of a listing are valid?

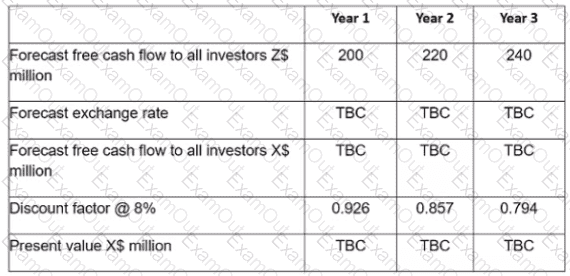

Company XXY operates in country X with the X$ as its currency. It is looking to acquire company ZZY which operates in country Z with the Z$ as its currency.

The assistant accountant at Company XXY has started to prepare an initial valuation of Company ZZY's equity for the first 3 years, however their valuation is incomplete. TBC' in the table below indicates that her calculations have yet to be completed.

The following information is relevant:

What is the correct figure (to the nearest million S) to include in year 3 as the present value in X$ million?

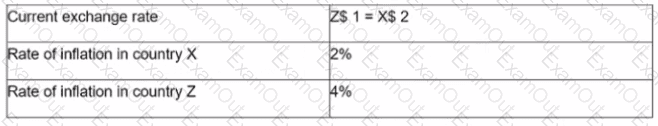

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

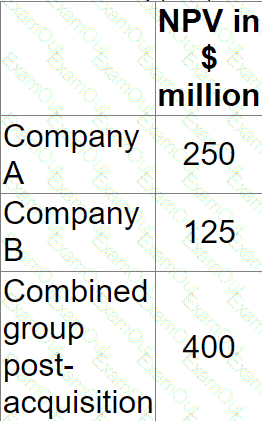

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A’s accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

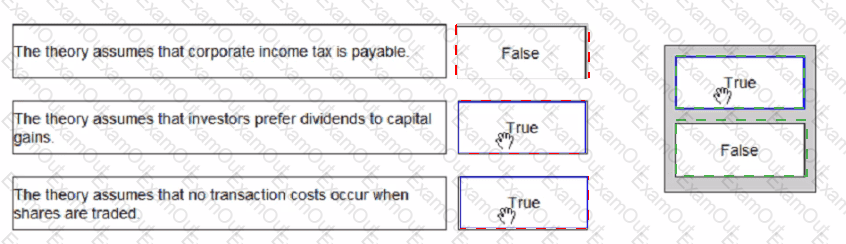

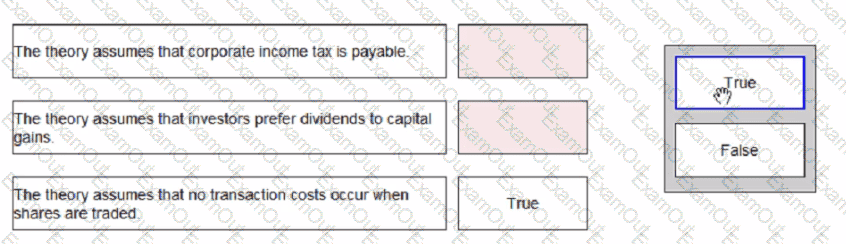

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.

M is an accountant who wishes to take out a forward rate agreement as a hedging instrument but the company treasurer has advised that a short-term interest rate future would be a better option.

Which of the following is true of a short-term interest rate future?

A geared and profitable company is evaluating the best method of financing the purchase of new machinery. It is considering either buying the machinery outright, financed by a secured bank borrowing and selling the machinery at the end of a fixed period of time or obtain the machinery under a lease for the same period of time.

Which is the correct discount rate to use when discounting the incremental cash flows of the lease against those of the buy and borrow alternative?

A UK company enters into a 5 year borrowing with bank P at a floating rate of GBP Libor plus 3%

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

The directors of a unlisted manufacturing company have prepared a valuation of their company using the price-earning method.

Their calculation is:

Value if the company‘s equity = $6 million x 10 =$60 million where.

$6 million is the company’s reported profit before interested and tax in the most recent accounting period and

10 is the average price-earnings ratio for all listed companies

Which THREE of the following are weakness of this valuation?

Clinic A provides free healthcare to all members of the community, funded by the central Government.

Clinic B provides healthcare which has to be paid for by the individual patients. It is a listed company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following statements are correct?