The ex div share price of Company A’s shares is $.3.50

An investor in Company A currently holds 2,000 shares.

Company A plans to issue a script divided of 1 new shares for every 10 shares currently held.

After the scrip divided, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

Which of the following best explains why the interest rate parity model is highly effective in practice?

Which three of the following are most likely be primary objectives for a newly established, unincorporated entity in the service sector?

A company generates operating profit of $17.2 million, and incurs finance costs of $5.7 million.

It plans to increase interest cover to a multiple of 5-to-1 by raising funds from shareholders to repay some existing debt. The pre-tax cost of debt is fixed at 5%, and the refinancing will not affect this.

Assuming no change in operating profit, what amount must be raised from shareholders?

Give your answer in $ millions to the nearest one decimal place.

$ ?

Company Z has just completed the all-cash acquisition of Company A.

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

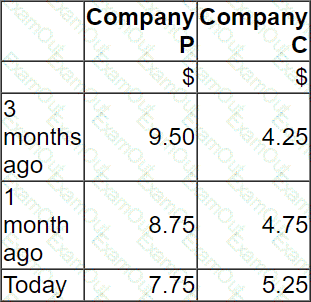

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

An all-equity financed company currently generates total revenue of $50 million.

Its current profit before interest and taxation (PBIT) is $10 million.

Due to difficult trading conditions, the company expects its total revenue to be constant next year, although some margins will reduce.

It forecasts next year's PBIT will fall to 18% on 40% of its revenue, but that the PBIT on the other 60% of its revenue will be unaffected.

The rate of corporate tax is 20%.

What is the forecast percentage reduction in next year's Earnings?

G pic wishes to borrow $5 million in 6 months, for a period of 3 months. A bank has quoted the following Forward Rate Agreement (FRA) rales:

3 v 9 6.55%-6.70% 6v9 6.70%-6 90%.

G pic can borrow at 0 75% above base rate, and the base rate is currently 6.25% Concerned that base rates may rise, G pic decides that it will hedge using an FRA

At the settlement date for the FRA, the base rate has risen to 7.50%

What is the effective interest rate paid by G pic for its borrowing?