Company Y plans to diversify into an activity where Company X has an equity beta of 1.6, a debt beta of zero and gearing of 50% (debt/debt plus equity).

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

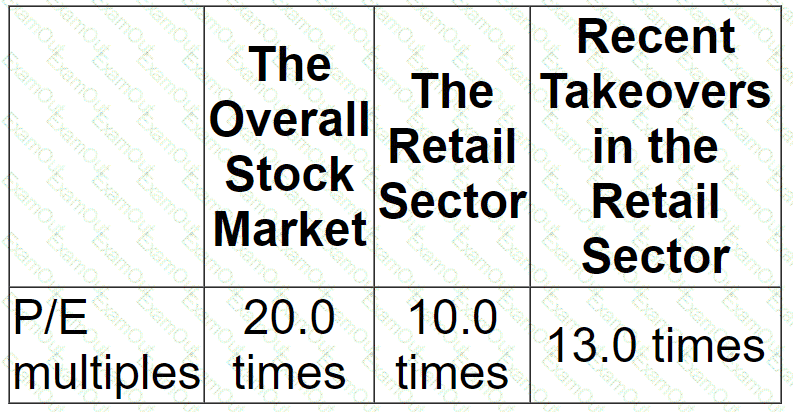

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

A company is concerned about the interest rate that it will be required to pay on a planned bond issue.

It is considering issuing bonds with warrants attached.

Advise the directors which of the following statements about warrants is NOT correct?

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

• Company BBA pays withholding tax of 25% on all cash remitted to the parent company

• Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

Company WWW is considering making a takeover bid for Company KKA Company KKA's current share price is $5.00

Company WWW is considering either

" A cash payment of $5.75 for each share in Company KKA

" A 5 year corporate bond with a market value of $90 in exchange for 15 shares in Company KKA

Calculate the highest percentage premium which Company KKA shareholders will receive.

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

Company Z wishes to borrow $50 million for 10 years at a fixed rate of interest.

Two alternative approaches are being considered:

A. Issue a 10 year bond at a fixed rate of 6%, or

B. Borrow from the bank at Libor +2.5% for a 10 year period and simultaneously enter into a 10 year interest rate swap.

Current 10 year swap rates against Libor are 4.0% - 4.2%.

What is the difference in the net interest cost between the two alternative approaches?

Company X is an established, unquoted company which provides IT advisory services.

The company's results and cashflows are growing steadily and it has few direct competitors due to the very specialised nature of it's business. Dividends are predictable and paid annually.

Company P is looking to buy 30% of company X's equity shares.

Which TWO of the following methods are likely to be considered most suitable valuation methods for valuing company P's investment in Company X?