Delta and Kappa both wish to borrow $50m.

Delta can borrow at a fixed rate of 12% or at a floating rate of the risk-free rate +3%

Kappa can borrow at 15% fixed or the risk-free rate +4%.

Delta wishes a variable rate loan and Kappa a fixed rate loan The bank for the two companies suggests a swap arrangement The two companies agree to a swap arrangement, sharing savings equally

What is the effective swap rate for each company?

Company A is planning to acquire Company B. Both companies are listed and are of similar size based on market capitalisation No approach has yet been made to Company B's shareholders as the directors of Company A are undecided about the most suitable method of financing the offer Two methods are under consideration a share exchange or a cash offer financed by debt.

Company A currently has a gearing ratio (debt to debt plus equity) of 30% based on market values. The average gearing ratio (debt to debt plus equity) for the industry is 50% Although no formal offer has been made there have been market rumours of the proposed bid. which is seen as favorable to Company A. As a consequence. Company As share price has risen over the past few weeks while Company B's share price has fallen.

Which THREE of the following statements are most likely to be correct?

Which TIIRCC of the following are most likely to reduce the long term credit rating co a company?

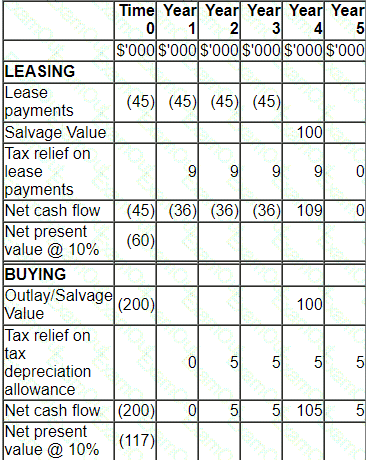

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

• Four year lease contract.

• Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

• The interest rate payable on the bank borrowing is 10%.

• The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

• A salvage or residual value of $100,000 is estimated at the end of the project's life.

• Purchased assets attract straight line tax depreciation allowances.

• Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Which of the following statements is true of a spin-off (or demerger)?

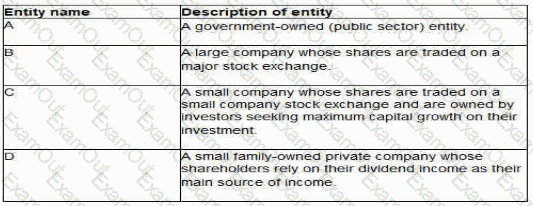

The directors of the following four entities have been discussing dividend policy:

Which of these four entities is most likely to have a residual dividend policy?

A private company manufactures goods for export, the goods are priced in foreign currency B$.

The company is partly owned by members of the founding family and partly by a venture capitalist who is helping to grow the business rapidly in preparation for a planned listing in three years' time.

The company therefore has significant long term exposure to the B$.

This exposure is hedged up to 24 months into the future based on highly probable forecast future revenue streams.

The company does not apply hedge accounting and this has led to high volatility in reported earnings.

Which of the following best explains why external consultants have recently advised the company to apply hedge accounting?

A listed company is planning a share repurchase.

The following data applies:

• There are 10 million shares in issue

• The share repurchase will involve buying back 20% of the shares at a price of $0.75

• The company is holding $2 million cash

• Earnings for the current year ended are $2 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

For which THREE of the following risk categories does IFRS 7 require sensitivity analysis?

A company wishes to raise additional debt finance and is assessing the impact this will have on key ratios.

The following data currently applies:

• Profit before interest and tax for the current year is $500,000

• Long term debt of $300,000 at a fixed interest rate of 5%

• 250,000 shares in issue with a share price of $8

The company plans to borrow an additional $200,000 on the first day of the year to invest in new project which will improve annual profit before interest and tax by $24,000.

The additional debt would carry an interest rate of 3%.

Assume the number of shares in issue remain constant but the share price will increase to $8.50 after the investment.

The rate of corporate income tax is 30%.

After the investment, which of the following statements is correct?