An all equity financed company reported earnings for the year ending 31 December 20X1 of $5 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 7%.

The company pays corporate income tax at 30%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

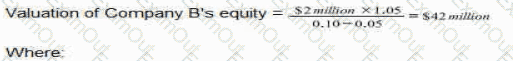

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

A company's current profit before interest and taxation is $1.1 million and it is expected to remain constant for the foreseeable future.

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

The corporate income tax rate is 20% and is expected to remain unchanged.

Which of the following is the best estimate of the current share price?

Which THREE of the following remain unchanged over the life of a 10 year fixed rate bond?

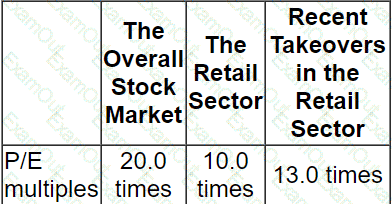

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

A company's Board of Directors is assessing the likely impact of financing future new projects using either equity or debt.

The directors are uncertain of the effects on key variables.

Which THREE of the following statements are true?

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

Which TWO of the following statements about debt instruments are correct?

A national airline has made an offer to acquire a smaller airline in the same country.

Which of the following would be of most concern to the competition authorities?

In the context of the Integrated Reporting