A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

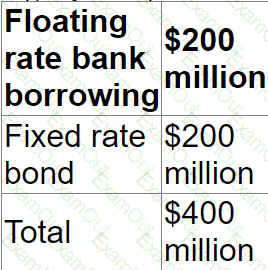

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

An unlisted company.

• Is owned by the original founders and members of their families

• Pays annual dividends each year depending on the cash requirements of the dominant shareholders.

• Has earnings that are highly sensitive to underlying economic conditions.

• Is a small business in a large Industry where there are listed companies with comparable capital structures

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

The ex div share price of a company's shares is $2.20.

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

Company ABE is an unlisted company that has been trading for 10 years. During this period, it has seen substantial growth in revenue and earnings. For the company to continue its growth it needs to raise new finance The directors are considering an initial public offering (IPO).

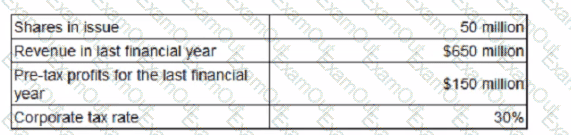

The following information is relevant to Company ABE:

A listed company of similar size and in the same industry as Company ABE had earnings per share in the last financial year of $1 80 Its shares are currently trading at a price / earnings ratio of 12.

The directors of Company ABE have asked for advice on what price they might expect if the company is listed on the stock exchange by means of an IPO.

Using the information provided what is an estimated issue price for each share in Company ABE?

Give your answer to 2 decimal places.

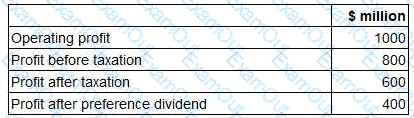

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Which THREE of the following long term changes are most likely to increase the credit rating of a company?

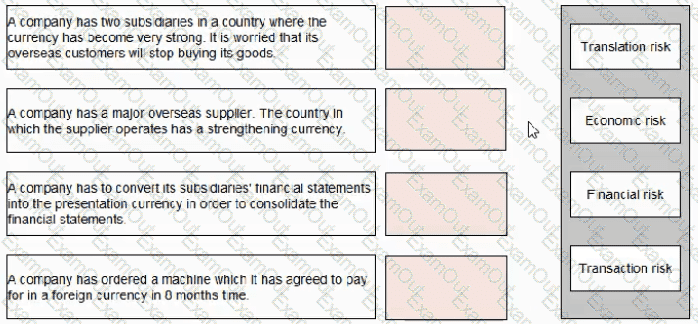

Select the category of risk for each of the descriptions below:

DFG is a successful company and its shares are listed on a recognised stock exchange. The company's gearing ratio is currently in line with the industry average and the directors of DFG do not want to increase the company's financial risk. The company does not carry a large cash balance and its shareholders are not expected to be willing to support a rights issue at this time

LMB is a small services company owned and managed by a small board of directors who are going to retire within the next year

DFG wishes to purchase LMB and has approached LMB's owners, who are broadly open to the proposal, to discuss the bid and the consideration to be offered by DFG. LMB's owners explain to DFG that they are also keen to defer any tax liabilities they would be subject to on receipt of the consideration.

Based on the information provided, which of the following types of consideration would be most suitable to finance the acquisition?

Which of the following statements about companies seeking a stock market listing is correct?

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.