AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition.

At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the value of retained earnings that will be presented in the consolidated statement of financial position of ST as at 31 December 20X5?

AB owned 80% of the equity share capital of FG at 1 January 20X6. AB disposed of 10% of FG's equity share capital on 31 December 20X6 for $400,000. The non controlling interest was measured at $700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?

A group presents its financial statements in A$.

The goodwill of its only foreign subsidiary was measured at B$100,000 at acquisition. There have been no impairments to this goodwill.

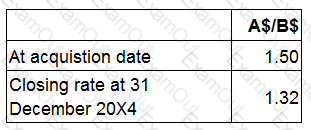

Exchange rates (where A$/B$ is the number of B$'s to each A$) are as follows:

The value of goodwill to be included in the group's statement of financial position in respect of its foreign subsidiary for the year ended 31 December 20X4 is:

Which of the following, in accordance with IFRS 2 Share-based Payments, are only applicable to the accounting treatment of cash settled rather than equity settled share-based payment schemes?

Select ALL that apply.

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

JK is seeking to raise new finance through a rights issue of equity shares.

Which THREE of the following statements are correct?

What is the total comprehensive income attributable to the non-controlling interest that will be presented in GHI's consolidated statement of changes in equity for the year ended 31 December 20X4?

GH is seeking to finance a substantial new project that is guaranteed to enhance the profitability of the entity. Its key determinants in deciding upon the best source of finance are to balance the following requirements:

1) to minimise the costs of issue of the finance;

2) to avoid the need to find cash to repay the source of finance; and

3) to ensure that the long-term gearing level does not increase.

Which of the following financing options best meets these requirements?