Which of the following statements are INCORRECT with regards to impairment of financial instruments; Select ALL that apply.

An entity undertakes an issue of new debt which has the effect of reducing the entity's weighted average cost of capital (WACC).

Which of the following would best explain why the WACC will have fallen?

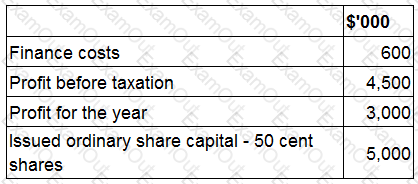

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

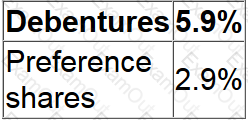

UV has raised $100,000 through the issue of two irredeemable financial instruments:

• 6% debentures with a current market value of $101.50 per $100 nominal value; and

• 8% preference shares with a current share price of $2.20 each.

The corporate income tax rate is 20%

What is the post tax cost of debt for each of these instruments?

A )

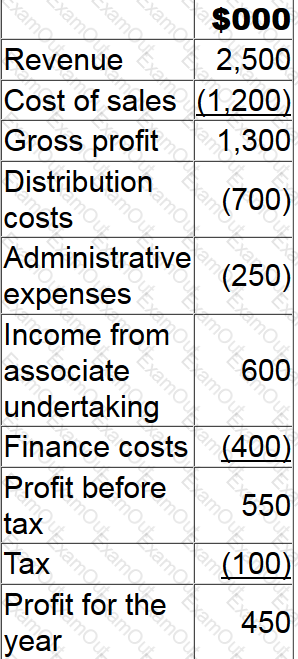

FG's statement of profit or loss account for year ended 31 December 20X1 is:

What is the operating profit margin for FG for the year ended 31 December 20X1?

Give your answer to the nearest whole %.

? %

JK is seeking to raise finance for a project and the directors would prefer to take out a fixed rate bank loan repayable over the next 5 years. The project will increase the profit of JK even after taking into account the additional interest costs.

Which of the following statements about the use of a bank loan in this situation is true?

CD granted 1,000 share options to its 100 employees on 1 January 20X8.To be eligible, employees must remain employed for 3 years from the grant date. In the year to 31 December 20X8, 15 staff left and a further 25 were expected to leave over the following two years.

The fair value of each option at 1 January 20X8 was $10 and at 31 December 20X8 was $15.

Which THREE of the following are true in respect of recording these share options in the year ended 31 December 20X8?

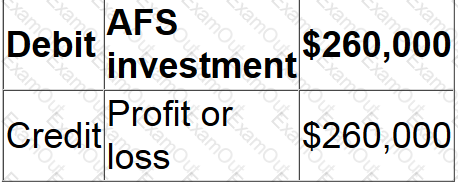

KL acquired 2 million $1 equity shares in MN on 18 July 20X0 for $1.65 a share and classified this investment as available for sale (AFS) in accordance with IAS 39 Financial instruments: Recognition and Measurement.

KL paid a 0.5% transaction fee to its broker on this transaction. MN's shares were trading at $1.78 on 31 December 20X0.

Which of the following journals records the subsequent measurement of this investment at 31 December 20X0?

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

KL acquired 75% of the equity share capital of MN on 1 January 20X8. The group's policy is to value non-controlling interest at fair value at the date of acquisition. MN acquired 60% of the equity share capital of PQ on 1 January 20X9 for $360 million.

At 1 January 20X9 the fair value of the non-controlling interest in PQ was $220 million and the fair value of the net assets of PQ at 1 January 20X9 were $320 million.

Calculate the goodwill arising on the acquisition of PQ at 1 January 20X9.

Give your answer to the nearest million.

$ ? million