GH owned 70% of the equity share capital of XY at 1 January 20X6. GH acquired a further 20% of XY's equity share capital on 31 December 20X6 for $430,000. Non controlling interest was measured at $600,000 immediately prior to the 20% acquisition.

Which of the following amounts will GH debit to non controlling interest when the 20% acquisition is adjusted for in its consolidated financial statements at 31 December 20X6?

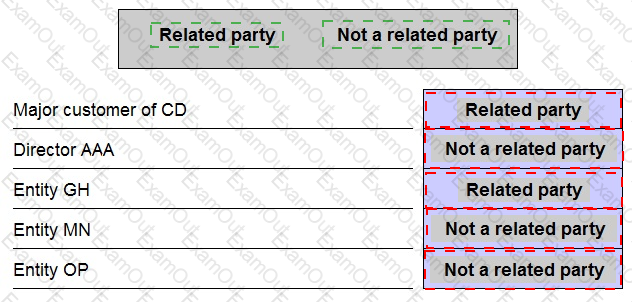

AAA is the only director of entity CD. AAA is also a director of entity GH. CD owns 30% of the equity of MN and 60% of the equity of OP.

Identify which of the following are related parties of CD by placing the appropriate response against one.

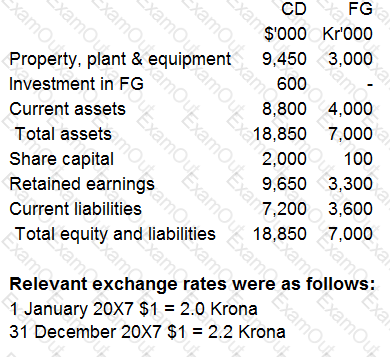

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January 20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Calculate the exchange difference arising on the retranslation of goodwill on the acquisition in the consolidated statement of financial position of CD at 31 December 20X7.

Give your answer to the nearest $000.

FGH plans to issue a large number of shares to the public via an IPO.

It is considering either an offer for sale at a fixed price or an offer for sale by tender.

Which of the following would be an advantage to FGH of using the offer for sale by tender compared to the fixed price offer?

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation.

Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

LM acquired an asset under a 5-year non-cancellable operating lease agreement on 1 January 20X8. Under the terms of the agreement, LM paid nothing for the first year and then made four payments of $50,000 in each subsequent year. LM adopted the provisions of IAS 17 Leases when accounting for this agreement.

Which of the following is correct in respect of this operating lease in LM's financial statements for the year to 31 December 20X8?

AB acquired 10% of the equity share capital of XY for $180 million in 20X4. On 1 January 20X8 AB acquired a further 45% of the equity share capital of XY for $900 million and at that date the original investment had a fair value of $200 million.

Place the correct values in the boxes below in order to complete the consideration transferred element of the goodwill calculation on the acquisition of XY.

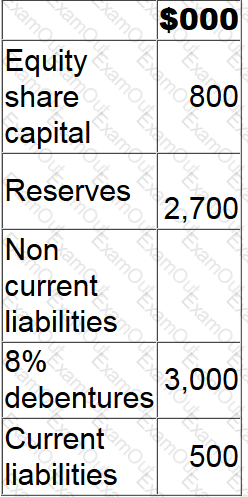

F has profit before interest and tax of $400,000 for the year to 30 June 20X4.

Extracts from F's statement of financial position at 30 June 20X4 are as follows:

Calculate the gearing (debt:equity) ratio at 30 June 20X4.

Give your answer to the nearest whole percentage.

? %