When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively.

Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

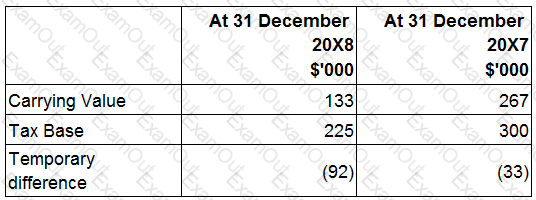

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

Which TWO of the following are relevant ethical considerations when selecting an accounting policy?

Which of the following is the correct calculation for basic earnings per share in accordance with IAS 33 Earnings Per Share?

ST granted 1,000 share appreciation rights (SARs) to its 100 employees on 1 December 20X7. To be eligible, employees must remain employed for 3 years from the grant date. In the year to 30 November 20X8, 10 staff left and a further 20 were expected to leave over the following two years. The fair value of each SAR was $12 at 1 December 20X7 and $15 at 30 November 20X8.

What is the accounting entry to record this transaction for the year to 30 November 20X8?

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?