When establishing a group structure, which of the following factors need to be considered: Select ALL that apply.

PQ entered into a $300,000 contract on 1 January 20X9 to provide computer hardware to WX with support services for the 3 years from the date of installation.

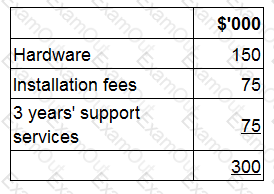

The contract is made up as follows:

The hardware was delivered to WX on 1 January 20X9 and installed immediately. WX paid the full value of the contract on 30 June 20X9.

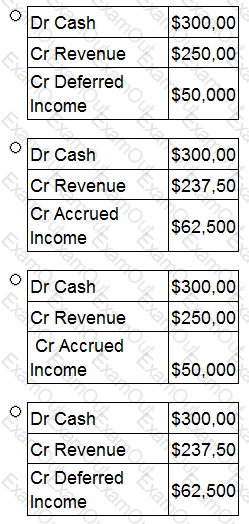

What journal entry records PQ's revenue from this contract for the year ended 31 December 20X9?

Which of the following statements about ST is true?

Which THREE of the following statements about preference shares are true?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

WX acquired 60% of the equity shares of CD on 1 January 20X3. WX sold 5% of the equity shares it held for $60,000 on 31 December 20X5. At that date the net assets of CD were $120,000 and the fair value of the non-controlling interest in CD was measured at $21,000. No goodwill arose on the original acquisition of CD.

When preparing its consoldiated financial statements, WX will process which of the following adjustments to its group retained earnings?

KL issued $100,000 of 6% convertible debentures at par on 1 January 20X7. These debentures are redeemable at par or can be converted into 5 shares for each $100 of nominal value of debentures on 31 December 20X9.

The share price on 1 January 20X7 is $18 a share. The share price is expected to grow at a rate of 7% a year.

The expected redemption value for each $100 nominal value of debentures on the date of conversion is:

Which of the following actions would be most likely to improve an entity's gross profit margin?

In recent years EBITDA has been adopted by large entities as a key measure of performance. The following figures have been extracted from the financial statements of UV for the year ended 30 November 20X9:

What is EBITDA for UV for the year ended 30 November 20X9?

Give your answer to the nearest $'000.

$ ? 000

AB acquired a financial investment on 1 January 20X9, incurring $5,000 related agency fees. AB initially classified the investment as held for trading, in accordance with IAS 32 Financial Instruments: Presentation.

Which of the following statements reflects the accounting treatment that AB adopted in respect of this investment when it prepared its financial statements to 31 December 20X9?