Which TWO of the following are true for an entity raising equity finance using a rights issue rather than a placing of equity shares to new investors?

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition.

At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the value of goodwill to be included in the consolidated statement of financial position of ST as at 31 December 20X5?

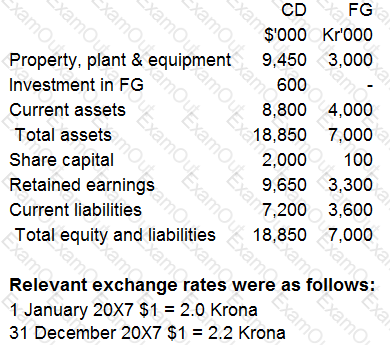

CD acquired 100% of the equity share capital of FG for cash consideration of Kr1,200,000 on 1 January 20X7.

Retained earnings of FG at the date of acquisition was Kr800,000. CD operates from Country A and its functional and presentation currency is $. FG is located and trades throughout Country B and its functional currency is the Krona (Kr).

CD has no other subsidiaries. Goodwill had not suffered any impairment to date.

Summarised data from the statements of financial position for both entities at 31 December 20X7 is presented below:

Which of the following is the correct application of IAS 21 The Effects of Changes in Foreign Exchange Rates in translating FG's statement of financial position into the presentation currency of CD for consolidation purposes at 31 December 20X7?

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

The yield to maturity of a redeemable bond is calculated as the internal rate of return of the relevant cash flows associated with the bond.

Which TWO of the following are considered relevant cash flows in this calculation?

EF has redeemable 10% bonds which are currently trading at $94.00 for each $100 of nominal value. The bonds can be redeemed at par in five years' time. The corporate income tax rate is 22%.

The present value of the cash flows associated with $100 nominal value of these bonds at a discount rate of 7% is $9.28.

Calculate the post tax cost of debt.

Give your answer as a percentage to one decimal place.

%

RS is a listed entity that has no subsidiaries although its Finance Director is also a director of TU, an unconnected entity.

It is preparing its financial statements to 30 September 20X6.

Which of the following substantial transactions must be disclosed in these financial statements in accordance with IAS 24 Related Party Disclosures?

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

JJ's current share price is $1.80, with a dividend of $0.20 a share just about to be paid.

Dividends have increased at an average annual growth rate of 4.5% and this is expected to continue into the future.

What is JJ's cost of equity?

Which of the following should be eliminated when using the equity method to account for associates in a parent's financial statements?

Select ALL that apply.