EFG is preparing its financial statements to 31 March 20X8. During the year ended 31 March 20X7, EFG purchased a piece of land for $1 million which is used as the staff car park. EFG has a policy of revaluing land, in accordance with International Accounting Standards, and at 31 March 20X8, accounted for a substantial increase in its value.

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8, which THREE of the following would be expected?

When consolidating for group accounts, a number of calculations and adjustments are required to properly combine the entities into a single group. Which of the following processes are involved in this consolidation

method?

Select ALL that apply:

LM has made the following share purchases during the year:

• Purchased 55% of the equity share capital of OP.

• Purchased 45% of the equity share capital of QR. LM have the power to appoint the majority of board members on the QR board.

• Purchased 30% of the equity share capital of ST. LM is represented by one director on the main board of ST which has five members in total. The other 70% of ST's equity share capital is owned by a single company, UV.

The Managing Director has told you that OP has performed well, but both QR and ST have not performed as expected. He is therefore pleased that OP will be included as a subsidiary and that QR and ST will only be included as investments in the group financial statements.

In accordance with the ethical principle of professional competence and due care how should the investments in OP, QR and ST be treated in the group financial statements?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

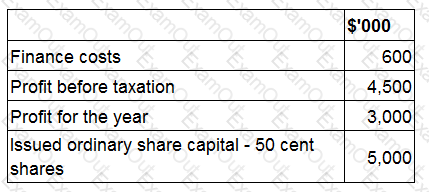

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

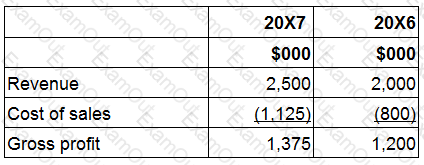

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

ST acquired 80% of the equity shares of AB on 1 January 20X7. AB acquired 60% of the equity shares of UV on 1 January 20X8. Profit for the year ended 31 December 20X9 for AB is $160,000 and for UV is $100,000.

Calculate the non-controlling interest figure to be included within ST's consolidated statement of profit or loss for the year ended 31 December 20X9.

Give your answer to the nearest whole number in $000s.

$ ?

XY purchased $100,000 of quoted 8% bonds in the current year which it intends to hold until redemption.

Which of the following identifies the correct classification and subsequent measurement basis for this financial instrument?

Operating segments are separately reportable where they exceed 15% of revenue / profits / assets. These must in total cover 80% of total revenue. Is this statement true or false?