Which of the following are limitations of financial statement figures for ratio analysis? Select the ALL that apply.

AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

An entity has declared a dividend of $0.12 a share. The cum dividend market price of one equity share is $1.40.

Assuming a dividend growth rate of 7% a year, what is the entity's cost of equity?

FG granted share options to its 500 employees on 1 August 20X0. Each employee will receive 1,000 share options provided they continue to work for FG for the four years following the grant date. The fair value of the options at the grant date was $1.30 each. In the year ended 31 July 20X1, 20 employees left and another 50 were expected to leave in the following three years. In the year ended 31 July 20X2, 18 employees left and a further 30 were expected to leave during the next two years.

The amount recognised in the statement of profit or loss for the year ended 31 July 20X1 in respect of these share options was $139,750.

Calculate the charge to FG's statement of profit or loss for the year ended 31 July 20X2 in respect of the share options.

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

MN had the following profit figures for the year ended 30 November 20X6:

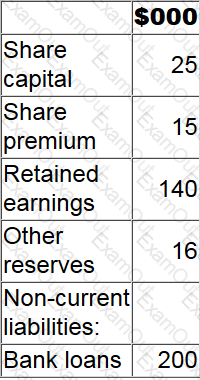

MN's statement of financial position at 30 November 20X6 included the following:

Calculate return on capital employed for MN for the year ended 30 November 20X6.

Give your answer to one decimal place.

? %

Which of the following is a related party according to the definition of a related party in IAS24 Related Party Disclosures?

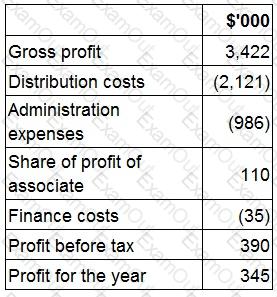

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

At 31 October 20X1 RS has in issue 10% debentures 20X8 with a carrying value of $350,000.

Extracts from its statement of profit or loss for the year ending 31 October 20X7 are as follows:

What is the interest cover for RS for the ended 31 October 20X7?

Which of the following is the correct calculation for basic earnings per share in accordance with IAS 33 Earnings Per Share?