For an entity to be exempt from preparing consolidated financial statements it must meet certain criteria specified in IFRS 10 Consolidated Financial Statements.

Which of the following conditions would give exemption from preparing consolidated financial statements?

An entity has a number of subsidiary and associate investments.

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

The financial statements of JK for the year ended 31 August 20X4 were approved on 10 November 20X4.

Within these financial statements which of the following would have been treated as a non-adjusting event in accordance with IAS 10 Events After the Reporting Period?

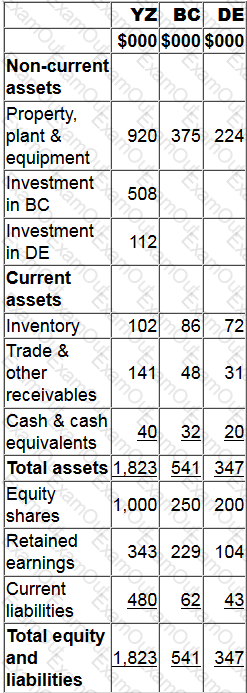

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the value of the investment in associate to be recognised in the consolidated statement of financial position at 31 March 20X2.

Give your answer to nearest whole $.

Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of 20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

Which of the following is the responsibility of the International Financial Reporting Standards Interpretations Committee?

Which of the following is a condition that has to be met for an entity to be exempt the requirement to prepare consolidated financial statements?

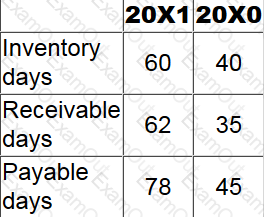

PZ has the following working capital ratios:

Which of the following could be the reason for the movements?

The subsidiary company of Group XY has purchased £150,00 worth of goods its parent company. However the goods purchased have yet to arrive at the subsidiary at the end of the financial year 20X4, meaning there is

a disagreement in the current account balances between the parent and subsidiary.

With Group XY looking to produce its CSOFP for the end of the financial year, which of the following statements are true in relation to accounting for this disagreement? Select ALL that apply.

Which of the following is a characteristic of a defined contribution post-employment benefit scheme?