The tax rules in a country state that all tax returns must be filed by 31 March each year and that any outstanding tax balance must be paid by 14 April each year. An entity filed its tax return on 10 April 20X2 and paid the outstanding tax on 20 April 20X2.

Which TWO of the following powers is the tax authority likely to have in respect of these actions by the entity?

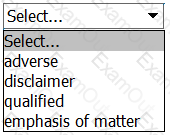

The auditor has identified a material but not pervasive mis-statement whilst undertaking the external audit of an entity's financial statements.

This will result in a modified audit report with the opinion being .

Which of the following would NOT be assessed for tax under a Pay-As-You-Earn system?

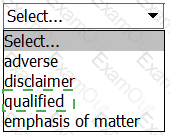

Which THREE of the following are included in the International Accounting Standards Board's "The Conceptual Framework for Financial Reporting"?

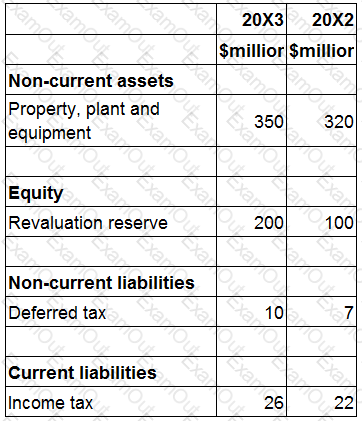

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What figure should be included within cash flows from investing activities for the proceeds of sale of plant and equipment?

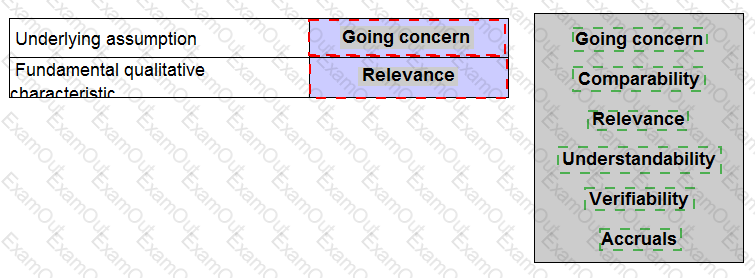

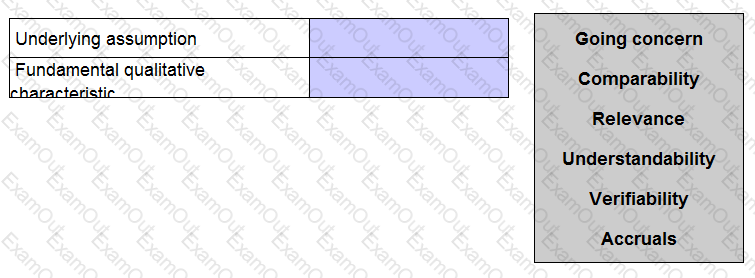

The Conceptual Framework for Financial Reporting issued by the International Accounting Standards Board (known as the IASB's conceptual framework) includes one underlying assumption about the preparation of financial statements and two fundamental qualitative characteristics for financial information.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the options in each of the boxes below.

Which of the following is a type of short-term finance?

An entity acquires 100% of the equity shares in another entity.

The consideration paid for the shares is less than the fair value of the net assets acquired.

Which of the following is the correct accounting treatment for the difference between the consideration paid and the fair value of the net assets acquired, in accordance with IFRS 3 Business Combinations?

UV has recently been having cash flow issues due to its credit customers paying after the credit period they have been granted.

UV is looking into factoring the receivables to a factoring company on a recourse basis to improve its cash flow.

Which TWO of the following will UV encounter as a result of employing the factoring company?

AA manufactures computers. These are sold to BB at $100 a computer plus a 5% sales tax. BB subsequently sells the computers to CC for $200 a computer plus a 5% sales tax. C sells the computers to customers at $300 a computer plus a 5% sales tax.

The total tax received by the tax authority is $30.

Which type of tax is described above?