Which THREE of the following are principles identified by the Code of Ethics?

CDE has been offering its customers a 50-day credit period, but now wants to improve its cash flow.

CDE is proposing to offer a 2% discount for payment in 20 days. "

Assume a 365-day year and an invoice value of $100

Which of the following is the effective annual interest rate CDE will incur for this action?

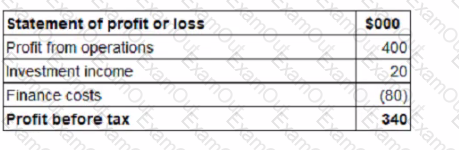

Below are extracts from LLL's financial statements for the year ended 31 December 20X2.

Depreciation of $25,000 was charged on properly, plant and equipment in the year and there were no disposals

What is the cash generated from operations for inclusion in LLL's statement of cash flows for the year ended 31 December 20X2?

BCD owns an item of plant which cost $20,000 and at the time of purchase was assessed to have a useful economic life of 8 years and a residual value of $2,000

The carrying amount of the plant at 1 January 20X8 is $11,000. On that date BCD's directors estimate that the plant's remaining useful life is now 6 years The residual value remains unchanged at $2,000

What is the depreciation charge for this plant for the year ended 31 December 20X8?

Give your answer to the nearest $.

Which THREE of the following would be included in a cash budget?

An entity's policy is to finance the investment in working capital using short-term financing to fund all of its investment in fluctuating net current assets as well as some of its investment in permanent net current assets.

What is this working capital financing policy known as?

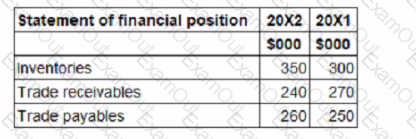

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the profit attributable to the non-controlling interests disclosed in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

Give your answer to the nearest whole $.

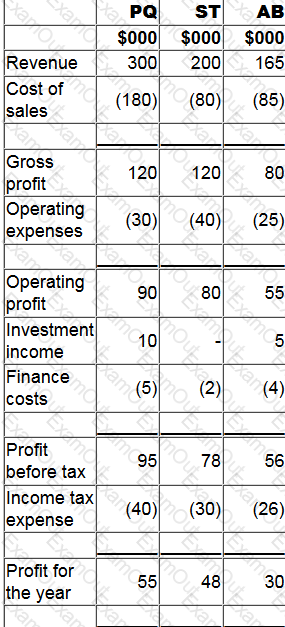

XYZ has the following data relating to the forecast sale of goods for the quarter to 31 December 20X2:

XYZ expects trade receivables to be settled as follows:

• 20% in the month of sale, by offering a settlement discount of 5%;

• 30% in the month following sale, and

• the remainder, after allowing for irrecoverable debts, in the subsequent month

$10,000 of the sales made in October 20X2 are expected to be irrecoverable

What is the forecast amount to be received by XYZ from trade receivables in December 20X2?

Which THREE of the following are part of the International Accounting Standards Committee (IASC) Foundation structure?

On 1 May 20X8 DEF enters into a contract to lease plant with a fair value of $200,000. Annual lease payments of $50,000 are to be paid in advance and DEF incurred direct costs to arrange the lease of S2.000 The present value of future lease payments at 1 May 20X8 is $190,000.

What is the amount to be recognised as a right-of-use asset on 1 May 20X8?