WX is considering an investment in ST.

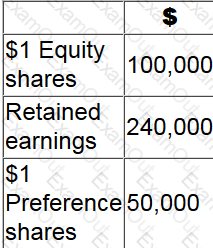

At 31 December 20X2 ST had the following balances in its statement of financial position:

Which of the following would cause ST to become an associate investment of WX?

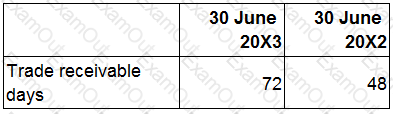

The following information relates to ABC.

Which of the following would be a reason for the movement in the trade receivable days?

Which of the following would NOT be a source of taxation rules for a country?

Which TWO of the following are features of a bank overdraft?

STU has a non-current asset which originally cost $250,000, has an expected life of 8 years and an estimated residual value of $25,000. The asset is depreciated at 25% a year on a reducing balance basis On 1 July 20X5 the accumulated depreciation for this asset is $109,375

What is the depreciation charge for the year ending 30 June 20X6?

Give your answer to the nearest whole number.

Which THREE of the following statements are true?

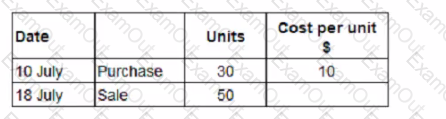

On 1 July 20X8 JKL has 100 units of inventory, which cost $8 each. The following transactions arose during the month of July:

JKL values inventory using the first in. first out method.

What is the value of JKL's inventory at 31 July 20X8?

Give your answer to the nearest $.

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

KL has S90.000 of plant and machinery which was acquired on 1 June 20X4. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for 560,000 on 1 June 20X6

Calculate the tax balancing allowance or charge on disposal tor the year ended 31 May 20X7 and state the effect on the taxable profit.

Which of the following are techniques that can be used by a company to ensure they receive timely payment of receivables? Select ALL that apply: