On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

Which of the following is NOT a reason why financial reporting information needs to be regulated?

Which of the following correctly identifies the order of the steps involved in the development of an International Financial Reporting Standard prior to it being issued?

HI commenced business on 1 April 20X3. Sales in April 20X3 were $30,000. This is forecast to increase by 2% per month.

Credit sales accounted for 50% of sales. Credit sales customers are allowed one month to pay; 75% of April credit customers paid on time. A further 20% are expected to pay after more than one month, but before two months. The remaining 5% are not expected to pay. All these percentages are expected to continue in the near future.

Calculate the total amount of cash HI should forecast to be received in June 20X3.

Give your answer to the nearest whole $.

CDO is an entity that is preparing to apply to its local stock market for a listing. CDO is currently run by a board of ten directors, each of whom manages a department of CDO. The board is chaired by Ms E who is also CDO's Chief Executive Officer.

Which TWO of the following actions would assist CDO to meet corporate governance regulations?

Company Y is using some of the money from a share issue to purchase a new office building. The company is also using some of the money to purchase inventories. Which method of financing is this?

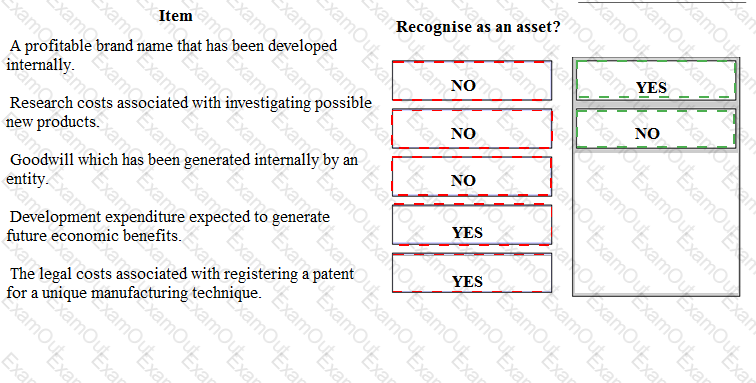

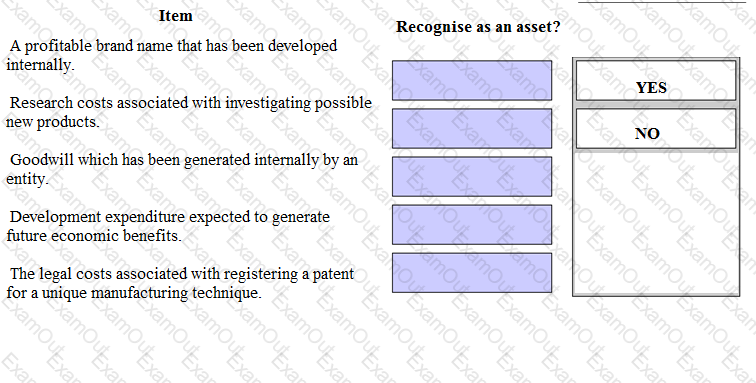

Identify from the list below which items can be recognised as assets within the financial statements of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against each item.

A specialized product was commissioned by a customer and the agreed price was $38,000. The product was completed at a cost of $34,000.

It was then discovered that new regulations meant that the specialized product now failed health and safety requirements. The specialized product had to be modified to meet the new regulations at a cost of $9,000. The customer agreed to pay an extra $3,000 towards the modifications.

At 31 December 20X5 the specialized product was still in inventory and had not been modified.

Calculate the value of the specialized product that should be included in inventory as at 31 December 20X5.

Give your answer to the nearest whole $000.

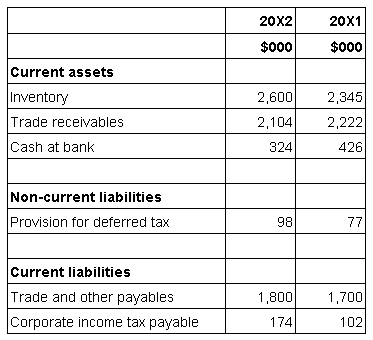

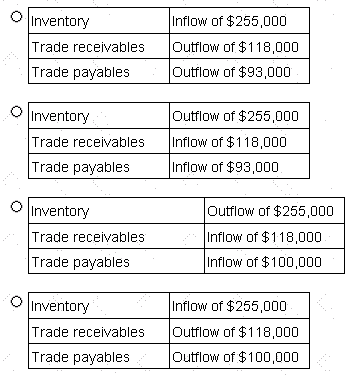

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

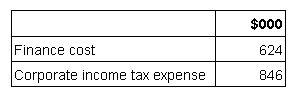

The following information if included within OO's statement of profit or loss for the year ended 31 March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes finance lease interest within financing activities on its statement of cash flows.________________

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be included to reflect the changes in working capital within the net cash flow from operating activities?

In accordance with IAS 1 Presentation of Financial Statements, which of the following will be shown in the statement of changes in equity?