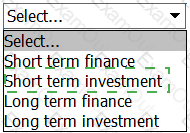

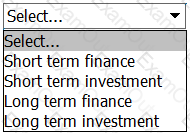

What is the correct classification of a 90-day government bond?

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

Mr AM is the owner of Waxco Ltd. Mr AM was born in India, but currently resides in the USA. He has gained dual Indian and American citizenship.

Mr AM first registered Waxco Ltd in the USA when he started the company ten years ago. However, because of lower costs, the company moved its central management station to Germany two years ago. Waxco Ltd

has other smaller offices such as call centres across Asia, in locations such as Pakistan and Cambodia, however Waxco Ltd only currently sell goods in the USA.

Which of the countries mentioned are relevant for determining Waxco Ltd's competent jurisdiction?

Entity T operates within several countries, but its country of residence is Country F. In 20X5, Entity T made $8.4 million in Country M. Country M has a flat rate corporation tax of 5.9%.

Country F and Country M operate a double taxation treaty which uses a foreign tax credit system. In Country F, there is a tax of 10% tax on all foreign income.

Taking into account the credit, what is the total tax liability that Entity T owes on its Country M income, in Country F?

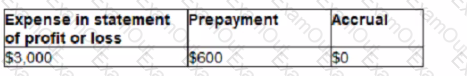

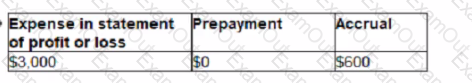

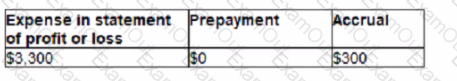

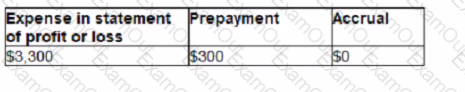

On 1 July 20X7, VWX enters into a 12-month lease for personal computers paying a non-refundable deposit of $600. Lease payments of $500 are paid monthly in arrears. VWX chooses to recognise the assets in the lease as short life and low value

Which of the following gives the correct value for the expense in the statement of profit or loss and corresponding prepayment and accrual in VWX's statement of financial position for the year ended 31 December 20X7?

A

B

C

D

While conducting their audit, auditor 0 did not encounter issues which significantly limited the scope of their audit, however they did run into problems in that they disagreed with the management on facts in the

statements.

These disagreements were somewhat material, but they did not affect the auditor's overall opinion of the business. Which of the following statements should auditor 0 issue?

On 1 January 20X6 PQR leases equipment for 3 years to use on a construction project. The total lease payments are $360,000 divided into 36 monthly instalments of $10,000 On 1 January 20X6 the present value of the lease payments is $270,000 and initial direct costs of $3,000 were incurred.

Which THREE of the following statements are true?

Entity RH has an recognised a taxable profit of $1.Smillion for 20X1'. In Entity RH's resident country. Country M, depreciation charges and entertaining expenses are disallowed expenses. Below is some information on

Entitry RH's outgoings for the period:

Depreciation charged on PPE: $450,000

Political donations: $155,000

Staff parties: $3,200

Cost of updating assets: $10,000

Other expenses: $83,500

In Country M, there is a standard corporation tax of 12% charged on all corporation profits. What is Entity RH's total tax liability for this period?

MN recently took out a 5 year term loan to buy raw materials to take advantage of a supplier's bulk discount that had been offered to them.

What approach to financing working capital has MN undertaken?