Which THREE of the following matters should an entity consider when determining the credit terms granted to a customer?

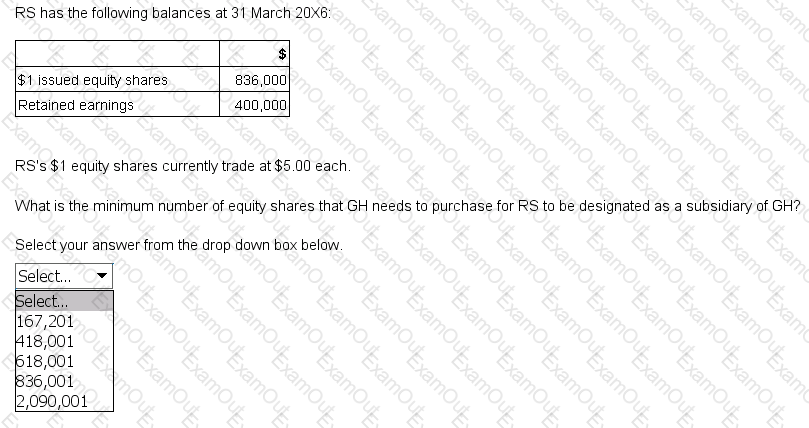

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

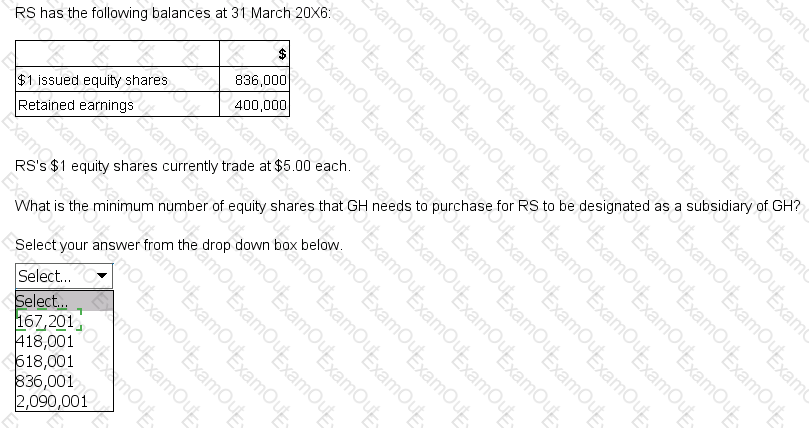

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

Mr K is being pressured by his manager to change figures in his report so that it will improve his manager's bonus.

His manager has promised Mr K a promotion if he agrees to do this.

What threats is Mr K facing?

QR purchased a property for its investment potential on 1 January 20X3 for $2.5 million.

The total property cost is split as follows: land $1 million and buildings $1.5 million. The buildings were expected to have a remaining useful life of 40 years.

The local property index at 31 December 20X3 indicates that the fair value of the property has risen by 10%.

What is the balance that QR will include in its statement of financial position at 31 December 20X3 for this property, assuming that it uses the IAS 40 Investment Properties fair value model?

Give your answer in $million to two decimal places.

Which TWO of the following statements about accounting for associates are true?

Which of the following would NOT normally be subject to a withholding tax?

OP holds an investment property purchased on 1 January 20X3 for $700,000 with a useful economic life of 25 years.

At 31 December 20X5 the fair value of the investment property was $750,000 with a revised useful economic life of 25 years from that date.

OP has been carrying the investment property using the cost model until 31 December 20X5.

The directors wish to change their valuation method to fair value in accordance with IAS 40 Investment Property.

Which of the following is the correct treatment of the revaluation gain and the value of the property in the statement of financial position at 31 December 20X5?

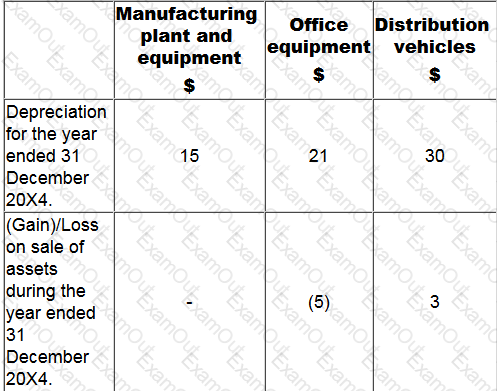

In Country X corporate income tax is levied on profits as follows:

Which of the following describes the tax rate structure in Country X?

An entity purchased equipment on 1 April 20X4 for $200,000. The equipment was depreciated using the reducing balance method at 20% a year.

Depreciation was charged up to and including 31 March 20X7. At that date the recoverable amount of the equipment was $94,000.

Calculate the impairment loss on the equipment in accordance with IAS 36 Impairment of Assets.

Give your answer to the nearest whole $.