AB sold a machine for $15,000 The machine had originally cost $160,000 and al the dale of disposal had a carrying value of $26,000.

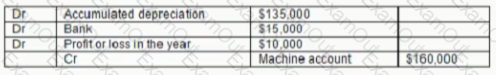

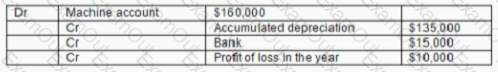

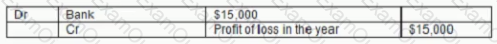

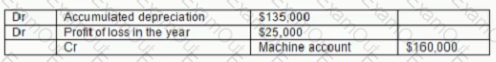

The journal entry lo record this disposal is:

A)

B)

C)

D)

The main aim of financial accounting is to:

Refer to the Exhibit.

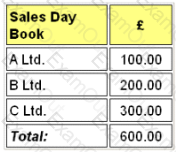

The sales day book for the last month, appeared as follows:

The entries which should be made in the ledger accounts are:

The answer is:

Refer to the Exhibit.

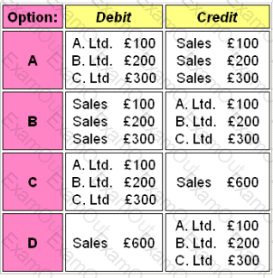

The following information is available for a company for the period:

The value of sales invoices for the period was:

A company has a year end of 31 December. Rent of $12,000 was paid on 1 October in year 1 to cover the period to 30 September year 2 and on 1 October year 2 $16,000 was paid for the following year

The figure for rent payable that should be shown in the income statement for the year 2 will be

In times of rising prices, the 'FIFO' method of inventory valuation, when compared to the 'Average Cost' method of inventory valuation, will usually produce:

An invoice to Sammy has been entered in the sales day book as $85 instead of $58.

To correct the position, which of the following procedures should be adopted?

Your company provides a number of staff with lap-top computers, as well as pocket calculators. It capitalizes the cost of the computers and depreciates them over several years, but writes off the cost of the pocket calculators in full, against profits, in the period in which they are purchased.

The main justification for this difference in treatment is:

Refer to the Exhibit.

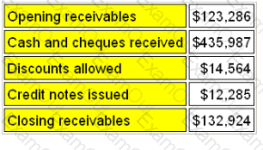

A company that is VAT-registered has the following transactions for the month of March.

All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The movement on the VAT account for the period was:

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.