The purpose of charging the income statement with depreciation on non-current assets is:

Company H receives a 10% discount on its order from supplier GD. Which ONE of the following does the discounted amount count as for Company H?

W and Partners has an opening capital balance at 1 January of £14,640 credit.

During the period there was an increase in assets of £6,820 and an increase in liabilities of £5,400.

The balance on the capital account at the end of the period is:

Financial controls are needed in order to:

Which of the following is an example of where the historic cost convention should be applied?

At the end of the year, the non-current asset register showed assets with a net book value of £170,300. The non-current asset accounts in the nominal ledger showed a net book value of £150,300.

The difference could be due to a disposed asset not having been removed from the non-current asset register, which had.

A company has profit before tax and dividends of £500000. The share capital consists of 1000000 ordinary shares of £1 each and 100000 10% preference shares of 50p each.

A 10p dividend was declared on ordinary shares.

Assuming there was no tax liability for the period, profit retained for the period was

A business has come to you for advice. There are about to start trading and want to ensure that they keep appropriate accounting records that will grow with their business, save time and produce useful information. They have already established books of prime entry.

Which of the following would you also suggest they use?

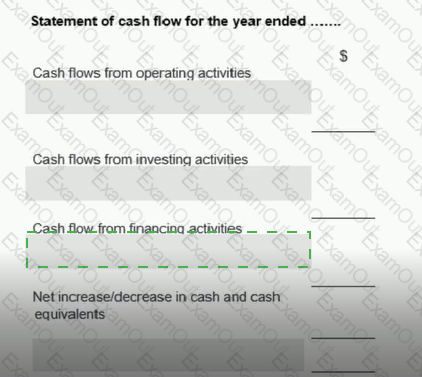

In which section of the statement of cash flow would cash from share issues be included? Select one of the following

Statement of cash How for the year ended.......

Which one of the following is not an example of an intangible asset?