Which one of the following is an example of where the accrual or matching convention should be applied?

Accountant P debited wages with £1,000 instead of £1,500, but credited sales with £1,500 instead of £2,000.

Which of the following kind of bookkeeping mistakes is this?

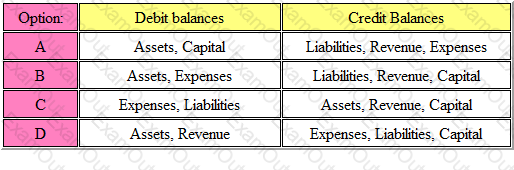

Refer to the Exhibit.

Which of the following balances normally result from the double-entry system of book-keeping?

The answer is:

Andrew is valuing the closing inventory at the lower of cost and net realizable value.

Which of the following concepts dictates his choice?

Who is responsible for ensuring that internal control systems operate efficiently?

In internal auditing, detection of fraud is an important objective. The auditors will best be able to detect frauds if they are knowledgeable in the most common methods of fraud.

Which THREE of the following are common methods of fraud?

If a profitable entity is not required to register for sales tax with its local tax authority, which of the following statements is TRUE?