Refer to the exhibit.

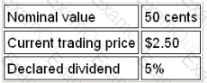

The following information is available about the ordinary shares of a public limited company:

A shareholder who purchased 20,000 shares at a price of $1.90 will receive a dividend of

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

At 31 December year 1, the electricity expenses account had a closing accrual of $300 as a result a credit balance was brought down at 1 January year 2

During year 2, electricity invoices totaling $4,000 were paid, including an invoice for $600 for the three months ended 31 March year 3

The charge of electricity in the income statement for year 2 is $

Company P are looking to create a balance sheet. Which of the following should be included in this document?

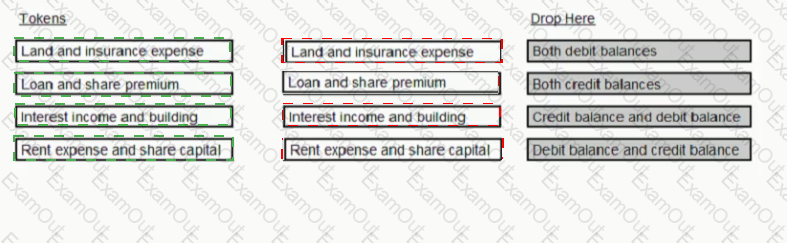

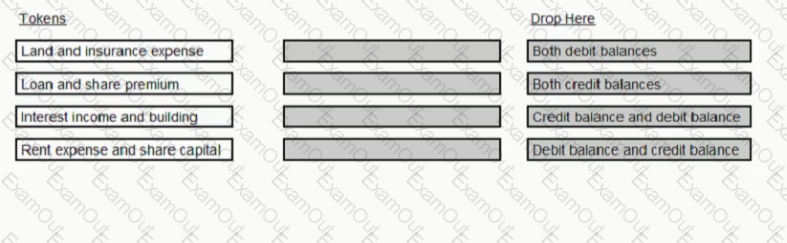

FGH has extracted its trial balance from its nominal ledger for the year ended 31 March 20X6 The items below have a value greater than SNil Which are debit and which are credit balances?

Refer to the Exhibit.

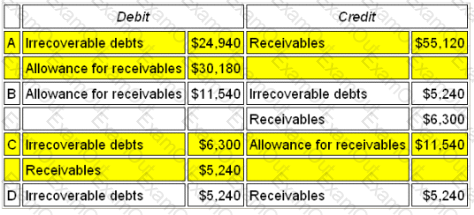

Soffit plc is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. Based on an aged receivables schedule, it is estimated that an allowance for receivables of $125,820 is required.

In addition, a specific allowance for receivables of $18,640 is also required for two customers who are experiencing cash flow difficulties. There are also two customers who have gone into receivership while owing the company $6,300. The current allowance for receivables is $156,000.

Which is the correct entry to be made to the accounts to record these transactions?

On 31 December 20X6 GHI makes a bonus issue of 50,000 shares On this dale the nominal value of the shares is $1 and the market value is $3 GHI has a share premium account with a substantial credit balance. The share capital account is credited correctly in the nominal ledger. Which of the following statements is TRUE?

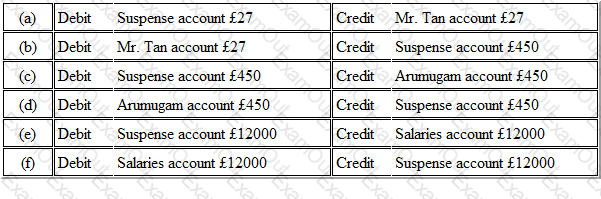

Refer to the exhibit.

The trial balance of Monchu Partnership, as at 30 June 2006, has a suspense account. Subsequent investigations revealed that:

(1) A payment of £352 to Mr. Tan was posted as £325.

(2) A remittance of £450 received from Arumugam was credited to Armits accounts.

(3) Salaries of £12000 have not been posted from the cash book.

Monchu suggested the following adjustments:

The appropriate journal entries are:

Which one of the following would not be classified as an efficiency ratio?

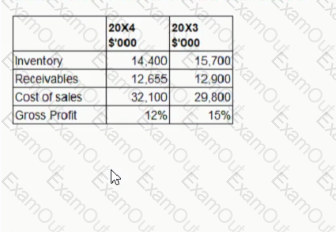

ABC produces accounts lo the year ended 31 December annually Extracts from the most recent financial statements are.

Calculate the average inventory days ratio for the year ended 31 December 20X4.

Give your answer to the nearest day