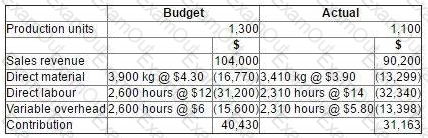

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The variable overhead expenditure variance for the period was:

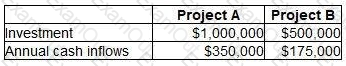

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?

The staffing policy for a supermarket is to have one cashier station open for every forecasted 20 customers per hour. Cashiers are hired by the hour as and when required, and do not perform any other duties.

The cost of the cashiers in relation to the number of customers would be classified as which type of cost?

According to CIMA’s Code of Ethics, CIMA members should not allow bias, conflict of interest of the influence of other people to override their professional judgement.

This is an example of:

In order for the information in a management accounting report to be authoritative its contents must be:

Which of the following would NOT be an appropriate performance measure for a profit centre manager?

Which of the following statements regarding variances is valid?

In responsibility accounting, costs and revenues are grouped according to:

Refer to the exhibit.

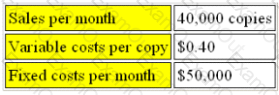

ZAP publishes a monthly magazine aimed at the teenage market. It has drawn up a budget for next year as follows:

The magazine is currently sold at $2.00 per copy.

The margin of safety is

Refer to the exhibit.

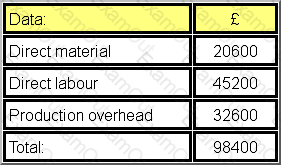

The following costs apply to batch 325, which consists of 10000 units of identical products:

The company charges selling and administration costs at a rate of 20% of production costs and wishes to achieve a profit margin of 20% of sales.

What is the required selling price per unit of product?

Give your answer to 2 decimal places.